Big opportunities for small banks

The deepening gloom at Citi, BofA and other large institutions gives community banks like Sterling Bancorp and First Niagara a chance to shine.

NEW YORK (Fortune) -- The deepening problems at big banks are giving their smaller, nimbler rivals a chance to play catch-up.

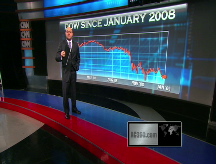

After years of willy-nilly expansion and soaring stock prices, the nation's biggest institutions are in deep trouble. Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500) each have received two infusions of government aid, and once-mighty firms such as Goldman Sachs (GS, Fortune 500) and Morgan Stanley (MS, Fortune 500) needed government support to help them get through the funding crisis.

Weighed down by the enormous losses at major institutions, banking industry profits recently hit an 18-year low, and early trends in 2009 aren't promising.

The KBW Bank index dropped 35% in January, as investors fretted over rising loan defaults and the possibility that further government aid could wipe out shareholders.

But as serious as the biggest banks' problems are, it would be a mistake to assume the entire industry is suffering.

"A lot of bankers are saying there's unique opportunity right now," said John Millman, president of Sterling Bancorp (STL), the New York-based parent of Sterling National Bank. "There's a window of opportunity for banks like ours, because people running small companies feel disenfranchised by the way the big banks have operated."

Millman said the problems at big banks give Sterling, which has $2.1 billion in assets, and other community banks a better chance to expand than they have had in years. He said Sterling has the advantage of "knowing its customer" better than big rivals such as Citi and JPMorgan Chase (JPM, Fortune 500), whose assets run into the trillions of dollars.

That, Millman said, is why Sterling -- which got $42 million from the government under the Troubled Asset Relief Program in December -- has continued lending even as the economy has stumbled in recent months.

"We have shown double-digit increases in loans in each of the past three years, and we plan to keep doing that," said Millman.

Growth for the nation's smaller banks represents a reversal of trends from the last twenty years, when the biggest banks got much bigger and many of the smallest players were gobbled up or driven under.

Over the past decade and a half, banks with more than $10 billion in assets more than doubled their share of the nation's deposits, to 71% last year from 32% in 1992, according to an industry study published last month by Celent, a Boston-based consultancy.

At the same time, market share of deposits at the smallest institutions -- those with less than $100 million in assets -- has dropped by more than half.

There are several reasons for this. Consolidation in the banking industry has been driven in part by increasing technical challenges, such as the rise of Internet banking, online bill payment as well as various compliance regimes, including a Treasury department program that keeps an eye on overseas wire transfers.

The more tasks that banks had to juggle, the less efficient the smaller banks became, wrote Celent analyst Bart Narter in a report detailing the decline of community banks.

This is clear when looking at the high level of noninterest expense as a proportion of income -- what's known in the industry as a bank's efficiency ratio -- for many small banks.

But while some banks have tended to become more efficient as they grow larger, Narter noted that the largest banks often don't show the greatest efficiency. This now seems unsurprising given the deep problems that the biggest institutions have faced over the past year.

"They actually experience diseconomies of scale," Narter wrote of the biggest banks. "There are so many large autonomous divisions of the bank that the complexity of connecting them overwhelms the advantage of size."

As big banks struggle to find a way forward and rising loan losses threaten to punish poorly run banks of all sizes, smaller but well capitalized institutions have a long-awaited chance to expand.

"There's no question it's a good time to look for purchases," said John Koelmel, CEO of First Niagara Financial (FNFG), a Lockport, N.Y., bank with $9.1 billion in assets that got $184 million from TARP last year.

Koelmel said that while First Niagara's first priority is to strengthen its foundation so it can take advantage of the "tremendous opportunities" that may arise over the next year or two, he believes the bank may have opportunities to grow even sooner than that.

Indeed, some smaller banks are so confident of their prospects -- or so unwilling to part with their freedom to operate as they see fit -- that they are turning down Treasury capital infusions.

Banks ranging from tiny Friendly Hills Bank of Whittier, Calif., to New York Community Bancorp (NYB), a Westbury, N.Y. bank with $32.5 billion in assets, have declined to accept TARP injections ranging from $1.6 million to $596 million.

The TARP rejection letters are coming even as the Federal Deposit Insurance Corp.'s third-quarter banking industry profile, published in November, portrayed an industry crumbling under the weight of bad loans.

Profits for all banks in the first nine months of 2008 -- the latest period for which data are available -- plunged 58% from a year earlier.

But Koelmel said banks such as First Niagara have shown they appreciate the need to "earn it every day" with customers, investors and others.

"We're very pleased with what we've been able to accomplish," Koelmel said of the bank, which last week reported a 9% rise in 2008 operating profits and a 14% rise in commercial loan volume.

First Niagara shares, despite a 40% drop over the past year, have outperformed those of its peers, giving the bank a bigger market value than some rivals with more assets and deposits.

"The lesson is that the big guys weren't necessarily smarter than the rest of us," Koelmel said. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More