Pending home sales rise in December

The number of sales contracts signed increased by 6.3%, as buyers respond to fire sale prices driven by a record number of foreclosures.

NEW YORK (CNNMoney.com) -- Plunging home prices and low mortgage rates pushed homebuying activity higher in December, according to a regular industry report released on Tuesday.

The Pending Home Sales Index, from the National Association of Realtors, measures the number of sales contracts signed each month. It rose 6.3% in December to 87.7, after dropping 4% in November to a record low of 82.5.

The index was 2.1% higher than its December 2007 level.

"Significant uncertainty still clouds the housing market despite improved affordability conditions," said Lawrence Yun, NAR's chief economist, in a written statement. "For a sustainable housing market recovery, and a sustainable economic recovery, we need a significant housing stimulus for qualified borrowers,"

Sales of homes that were repossessed in foreclosure proceedings contributed significantly to the index's improvement. Repossessions and short sales, when homes are sold for less than what borrowers owe on their mortgage, now account for more than 30% of all U.S. home sales, according to real estate Web site Zillow.com.

Sales activity gained the most traction the South, where the index jumped 13% in December. The Midwest was also much higher at 12.8%. The Northeast, however, slipped by 1.7% and the index in the West fell 3.7%.

Home sales also benefited from a drop in mortgage interest rates during the month. The 30-year, fixed-rate loan averaged 5.29% for the month, with the average borrower paying a fee equal to 0.7% of the mortgage principal. That was, by far, the lowest that mortgage rates had been all year.

The lower mortgage rates helped push housing affordability to record levels.

NAR's Housing Affordability index improved to 158.8 in December, up more than 29% year-over-year. That makes buying a home more affordable than any time since NAR started tracking the measure in 1970.

A household earning the median U.S. family income can now afford a home of $277,000, according to NAR. That's well above the national median home price, which was $198,600 in 2008.

Home prices have softened as foreclosures have soared, up 81% in 2008, according to RealtyTrac, the online marketer of foreclosed properties. That has added a lot of distressed homes to housing inventory, sending prices spiraling down for almost all sellers.

But home sales are still sluggish, according to Pat Newport, real estate analyst for IHS Global Insight, because lenders are still reluctant to fund many mortgages.

"What's holding up sales right now," he said, "is that the banks are still not lending to those with less than the best credit." He said most banks are turning down a large percentage of the purchase applications that they receive.

Bob Moulton, president of mortgage broker Americana Mortgage Group, said he's having trouble getting any loans approved by lenders. He recently had a client with a mediocre credit score of 630 who was putting 30% down ,and had substantial documented assets and income.

"The big commercial lenders wouldn't even look at him," said Moulton.

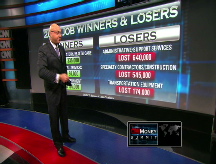

Also hurting sales, of course, is a lack of confidence among buyers amidst the uncertain economy, which has been marked by continuing job losses.

"Housing activity remains weak compared with potential demand," said NAR President Charles McMillan, a broker with Coldwell Banker Residential Brokerage in Dallas-Fort Worth. "The market is fragile given the economic backdrop." ![]()