Stocks slip in choppy session

Blue chips lead retreat as investors focus on weak earnings from Disney and Kraft, and more worries about the bank sector.

NEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday as weak earnings from Walt Disney and Kraft Foods and a selloff in the banking sector added to worries about the impact of the recession.

The Dow Jones industrial average (INDU) lost 121 points, or 1.5%. Weakness in Walt Disney and Kraft dragged on the blue-chip indicator after the companies reported results that missed forecasts.

The Standard & Poor's 500 (SPX) index lost 6 points, or 0.8%. The Nasdaq composite (COMP) lost 1 point or 0.1%.

After the close, Cisco Systems reported lower quarterly sales and earnings that nonetheless topped estimates.

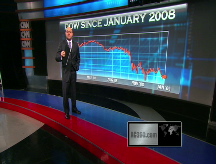

Since closing out the worst January ever, stocks have meandered as investors have worked through mostly disappointing corporate results and economic reports.

"The earnings and forecasts have been terrible, and we're probably in the teeth of the recession," said Thomas Nyheim, portfolio manager at Christiana Bank & Trust Company. "But the economic numbers today weren't as bad as had been expected, and that helps."

"The stimulus will ultimately pass and at some point in the second half of the year it will have an impact," he said. "I think people are trying to look forward to when all the money starts moving through the system."

Stocks rose Tuesday on better-than-expected earnings results from drugmakers and a surprise rise in a key measure of the housing market. But Wednesday's session was more turbulent.

Thursday brings reports on weekly jobless claims, fourth-quarter productivity and December factory orders.

Additionally, the nation's chain stores will be reporting January year-over-year retail sales. Sales are expected to remain weak as the recession cuts into consumer spending.

Economy: The Institute for Supply Management (ISM)'s services sector index improved to 42.9 from 40.1, versus forecasts for a drop to 39. It was the third economic report this week that was better than expected, following the ISM manufacturing index Monday and the pending home sales index Tuesday.

Most economists and market pros expect the recession to last through at least the end of this year. However, the reports have nonetheless helped reassure investors that some economic sectors are closer to stabilizing.

Wednesday also brought a pair of dour labor market reports ahead of the bigger government employment report due on Friday.

Payroll processing firm ADP reported that private-sector employers cut 522,000 jobs in January, versus forecasts for 535,000 job cuts. Employers cut 659,000 jobs in December.

Planned job cuts in January rose to nearly 242,000, up 45% from December, according to the latest report from outplacement firm Challenger, Gray & Christmas. The number of planned cuts was the highest level in seven years.

Another report showed that unemployment rose in 98% of metropolitan areas across the country in December.

Company news: Late Tuesday, Walt Disney (DIS, Fortune 500) reported weaker quarterly sales and earnings that missed expectations. Shares of the Dow component fell 8% Wednesday.

Kraft Foods (KFT, Fortune 500) reported lower quarterly earnings Wednesday of 43 cents per share that missed expectations by a penny per share. Shares fell 9%.

CNNMoney.com parent Time Warner (TWX, Fortune 500) reported quarterly sales and earnings Wednesday that missed estimates. The company also warned that 2009 profit would be flat with the previous year.

Bank of America (BAC, Fortune 500) lost 11% while the rest of the financial sector was mixed.

Select technology shares managed gains, protecting the Nasdaq from bigger losses. Yahoo (YHOO, Fortune 500), Intel (INTC, Fortune 500) and Applied Materials (AMAT, Fortune 500) all gained.

Market breadth was negative. On the New York Stock Exchange, losers beat winners nine to seven on volume of 1.39 billion shares. On the Nasdaq, decliners topped advancers eight to five on volume of 2.24 billion shares.

Washington: President Obama announced new rules Wednesday that cap compensation for executives at companies that take federal bailout money at $500,000.

After a narrow party-line approval in the House last week, the economic stimulus package is being debated in the Senate this week.

Bonds: Treasury prices inched higher, lowering the yield on the benchmark 10-year note to 2.89% from 2.88% Tuesday. Treasury prices and yields move in opposite directions.

Lending rates were mixed. The 3-month Libor rate rose to 1.24% Wednesday from 1.23% Tuesday, according to Bloomberg.com. The overnight Libor rate fell to 0.25% from 0.31% Tuesday. Libor is a bank lending rate.

Other markets: In global trading, Asian markets ended higher and European markets rose in afternoon trading.

The dollar rose versus the euro and yen.

U.S. light crude oil for March delivery fell 46 cents to $40.32 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery rose $9.70 to settle at $902.20 an ounce.

Gasoline prices rose 1 cent to a national average of $1.90 a gallon, according to a survey of credit-card swipes released Wednesday by motorist group AAA. ![]()