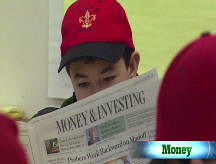

Talk your teen through tough economic times

Having a frank chat about the recession can ease kids' fears and prepare them for the future.

(Money Magazine) -- Dealing with the fallout from the financial crisis -- namely, the anxiety about your job and investments -- is hard enough. Talking about it all with teenage kids can be even more daunting. But it's a conversation worth having, especially now that they're old enough to share the stress. Not only can you ease their concerns, says Atlanta psychologist Mary Gresham, "you can turn these into teaching moments."

Help them understand what's going on. The last recession was in the early 2000s, meaning your children were probably too young to notice. This time they may grasp the severity of the situation even if they don't entirely understand it.

Explain what's happening -- consumers are spending less, stocks are falling, companies are cutting jobs -- and put it in perspective. Tell them that recessions occur regularly and that while this one may be especially severe, the economy will rebound.

Let them know how it's affecting your family. The biggest question on your kids' minds is probably: What does this mean to me? Answer this as straightforwardly as you can. "You don't want to convey anxiety, just the facts," says Gresham, who specializes in financial issues. Start with what's not at risk: their allowance, say, or your ability to pay the mortgage. (Whew! They won't have to move and leave their friends.)

Then say what could be vulnerable: your job, for example, or your ability to cover all their college costs. Tell them exactly how you plan to cope. "You can't just say, 'We're going to be okay,' " says New York City psychologist Marlin Potash, who focuses on money and relationships. "You must explain why you're going to be okay."

Involve them in decisions. With the 529s meant to cover his kids' college education down 25% last year, Allentown, Pa. financial adviser Russell Wild knew he needed to stash more this year in the plans. He explained this to his children, ages 12 and 15, adding that the more the family could save now - by moving this year's vacation from a European to a domestic destination, say - the less the kids might have to kick in for school later. With the issue framed that way, his son and daughter could see how the sacrifices they make now could benefit them later. Let your teens know about choices that affect them. Give them a chance to share their feelings and suggestions.

Make it a teaching moment. Even if your family hasn't been hurt by the downturn, your teens can still learn valuable lessons. Kathy Stepp, a financial adviser in Overland Park, Kans., showed her kids articles about foreclosure victims to warn them about getting overextended.

"I want them to understand the concept of living within their means," she says, "and the potential consequences if they don't." Use headlines about rising bankruptcy filings or news of a friend's parent being laid off to underscore the importance of saving money. Says David, Barnett, a Tustin, Calif. financial adviser: "Times like these really help explain why you need that emergency fund."

Need help with a financial dilemma? In an upcoming issue, Money magazine will be answering reader questions. Email money_letters@moneymail.com. ![]()