Who won't be helped by housing fix

The jobless and many of those who owe far more than home is worth won't benefit much from Obama's foreclosure prevention plan.

NEW YORK (CNNMoney.com) -- Don't have a job?

Struggling to keep up with payments on a home worth less than half the mortgage?

Owe way more than your home's value, but can still afford the payments?

Sorry, but you likely aren't among the 9 million people who may get help under President Obama's $75 billion foreclosure prevention program.

The program, unveiled Wednesday, is being hailed as the most comprehensive fix for the foreclosure crisis plaguing the nation. The president says it helps both responsible homeowners suffering from falling home prices and borrowers either at risk of or already in default.

But not everyone will benefit. The program does virtually nothing for the unemployed, who often don't have enough income to make any reasonable monthly payment affordable. And, since it relies more heavily on lowering interest rates than on reducing principal, it does little for borrowers concerned their homes will never recoup their value.

Take Joe Martinez of Bristow, Va., who fits the profile of the "responsible" homeowner Obama cited in the plan. The government contractor and his wife thought they did everything right when they bought their brand new $600,000 house two years ago. They put 5% down and got a 30-year fixed-rate mortgage they could afford.

Others in their neighborhood, however, couldn't keep up with the payments. As foreclosure rose, the value of the couple's home plummeted to $450,000, leaving them doubtful they'd ever recover their investment.

Martinez called their lender to try to get into the Hope for Homeowners program, which would reduce their loan balance to 90% of the home's current value. But they were turned down because they weren't in default.

So two months ago, the couple stopped paying their mortgage, hoping they could then qualify. But even if they don't, they are willing to take the hit on their credit scores to stop throwing money down the drain.

"There's just no point to stay here," said Martinez, 29, adding he could rent the house across the street for half his monthly mortgage payment. "We don't want to give up our home, but it's never going to come back."

The administration's program isn't designed to help every homeowner, experts said. Nor should it.

"It's a mistake to think we can stop all foreclosures," said Edward Morrison, a professor at Columbia Law School. "Only about one-third of existing foreclosures can be stopped."

The plan calls for loan servicers to modify mortgages for those at risk of or already in default so that the monthly payment is no more than 31% of the borrower's income. This will be done primarily through interest rate reductions, which are more palatable to most servicers than principal write-downs. The federal government will subsidize the interest rate reductions, as well as provide a multitude of incentives for servicers, mortgage investors and borrowers.

Also, borrowers with little or no equity in their homes who are on time with their payments could be eligible to refinance to take advantage of the current low interest rates, which hover around 5%. The plan lifts the guideline that borrowers must have at least 20% equity to refinance, allowing those with loans as large as 105% of their home's value to qualify. This is designed to help people who have seen their equity eaten away by falling home prices.

A growing number of people are falling behind in their payments because they've lost their jobs, ensuring the tidal wave of foreclosures will continue as long as unemployment keeps rising.

It's very tough, however, to help people who lose their income, experts said. Reducing monthly payments can only go so far since the loan's value after modification has to be worth more than it would be if the home were put into foreclosure. Those who lose their jobs often can't make payments large enough to overcome this hurdle.

For these people, the solution often is a short sale, in which the lender agrees to take forgive the loan balance above the home's sale price, experts said.

"In some cases, the homeowners can't stay in the home," said Marietta Rodriguez, director of the National Homeownership Program for NeighborWorks America.

The best way to help the unemployed facing foreclosure is to get them jobs, experts said. The Obama administration is addressing that in the $787 billion economic stimulus package the president signed into law on Tuesday. It is expected to create or save up to 3.5 million jobs.

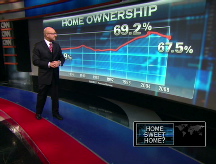

Many underwater borrowers -- those who owe more than their home is worth -- may find the plan falls short. Some estimates say up to 12 million homeowners may be underwater, with 4 million of them behind on their payments.

The danger is that some of these borrowers may decide it's just not worth it to continue paying if the home isn't likely to recoup its value. This is especially true of those finding it hard to make their payments.

Some struggling borrowers will qualify for lower monthly payments, but they will likely continue to be underwater. The government is offering to reduce their principal by $1,000 a year for five years, but that sum won't do much to bring them back into balance in most cases.

The only way to effectively help those with negative equity in their home is to forgive part of the loan balance, some experts say. They are disappointed that this measure is not given more emphasis in the program.

"Cutting principal is really what's needed to contain foreclosures," said Christian Menegatti, lead analyst for economic research firm RGE Monitor.

Other borrowers, however, are too far gone to get a modification.

"If you're so far underwater, more than about 150 percent loan-to-value, we think you're very unlikely to succeed -- those will not be eligible, as well," Housing Secretary Shaun Donovan said Wednesday.

As for those who can afford their payments, the program contains little to address their housing problems. Only those with loans worth 105% or less of their home's value can partake in the refinancing offer.

Martinez isn't interested in having his interest rate lowered. He would like to see some of his principal forgiven.

"Why would it be such a big deal for them to modify my loan?" he said, noting that his tax dollars are being used to finance the program. "Wouldn't that stabilize the economy?"

Some experts, however, say Martinez is the exception. Those who can make their payments aren't likely to walk away because still need a roof over their head, said Howard Glaser, a mortgage industry consultant.

"Homeowners aren't day traders in their homes," he said. "The investment value is not an issue." ![]()