SEC may charge Countrywide's Mozilo

Agency staff to recommend civil fraud charges against mortgage firm's founder, according to report.

|

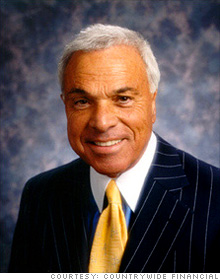

| Countrywide founder Angelo Mozilo |

NEW YORK (CNNMoney.com) -- Staffers at the Securities and Exchange Commission are recommending that the agency file civil fraud charges against Countrywide co-founder Angelo Mozilo, according to a published report.

The agency sent a notice to Mozilo telling him of the potential charges, which include violations of insider-trading laws and failing to disclose information to shareholders, according to the Wall Street Journal, which cited people familiar with the investigation. The agency may ultimately decide not to file charges.

Mozilo's attorney, David Siegel, declined to comment, but told CNNMoney.com that the "persistent innuendo" that Mozilo sold Countrywide shares because he knew of problems within the mortgage lender is "scandalous" and "inconsistent" with the facts.

"We do not believe there is any fair basis for allegations to be made against Mr. Mozilo," Siegel said in an e-mail. "All of Mr. Mozilo's stock sales were made in compliance with properly prepared and approved trading plans and reflected recommendations by his financial advisor over a long period of time."

An SEC spokesman declined to comment.

Mozilo, who founded the company in a New York apartment, built Countrywide into the nation's largest mortage lender. But Countrywide buckled during the housing meltdown and was acquired last year by Bank of America (BAC, Fortune 500).

Mozilo became a poster boy for the subprime crisis. He reportedly stood to collect a windfall of $115 million dollars in the $4 billion sale to Bank of America. But after facing heavy criticism from lawmakers, Mozilo said he would forfeit $37.5 million in payments tied to the deal. ![]()

Dumbest Moments in Business: Mozilo's 'disgusting' reply-all

Countrywide rescue: $4 billion

Cracking down on mortgage scammers