Bank of America shakes up its board

The troubled lending giant announced four new board members -- all of whom have banking experience.

|

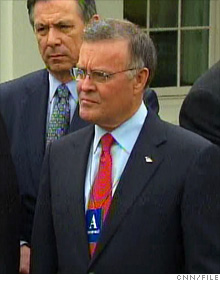

| Embattled Bank of America CEO Ken Lewis was stripped of his title as chairman by shareholders. |

NEW YORK (Reuters) -- Bank of America Corp on Friday appointed four outside directors to bolster its board's banking and financial expertise, after U.S. regulators pushed the nation's largest bank to improve governance after a federal bailout.

The shake-up increases pressure on Chief Executive Kenneth Lewis, who was stripped of his role as chairman in April after a surge in credit losses and the takeover of Merrill Lynch & Co. This led to a federal bailout for Bank of America in January, including $20 billion of new capital.

Bank of America (BAC, Fortune 500) said its new directors include two former regulators: Susan Bies, 62, who was a Federal Reserve governor from 2001 to 2007, and Donald Powell, 67, who chaired the Federal Deposit Insurance Corp from 2001 to 2005.

The other new members are D. Paul Jones, 66, who was chief executive of Alabama's Compass Bancshares Inc before selling it in 2007 to Spain's Banco Bilbao Vizcaya Argentaria, and William Boardman, 67, a retired vice chairman of Chicago's Bank One Corp, now part of JPMorgan Chase & Co (JPM, Fortune 500).

Regulators had pushed Charlotte, North Carolina-based Bank of America to overhaul its 18-person board. The addition of board members with banking experience recalls a similar shuffle at Citigroup Inc (C, Fortune 500), which also took $45 billion from the federal Troubled Asset Relief Program. Bies and Powell have also held senior roles at banks.

"The runway has become shorter" for Lewis, said Dan Genter, president of RNC Genter Capital Management in Los Angeles, which invests $2.8 billion. "Any control that Lewis had or any allegiance that he had gets diluted. He's going to have to start to gain some altitude, or in essence they're going to want him fired."

Lewis on Friday agreed to appear before the U.S. House Committee on Oversight and Government Reform on June 11 to discuss when he knew Merrill was on its way to a $15.84 billion fourth-quarter loss, the government role in the purchase, and the $20 billion bailout.

Walter Massey, who became chairman after shareholders in April voted to remove Lewis from that role, had led a committee of outside directors looking for new board members.

In a statement, Massey said the new directors "will make our board even stronger as we move our company toward achieving its true potential."

Lewis, Massey and the new directors were unavailable for comment.

The bank has said three directors have left since April. The Wall Street Journal said two others who have not been identified have also left, and the board may shrink further.

Lewis, 62, has said he would like to remain chief executive perhaps until 2012. While Lewis' departure "is not imminent," regulators asked Massey to think seriously about a succession plan, the Journal said, citing a person close to the process.

The identities of the new directors surfaced a day after Bank of America named Gregory Curl, who oversaw the purchase of Merrill and Countrywide Financial Corp, to replace Chief Risk Officer Amy Woods Brinkley, who was forced out.

Rep. Edolphus Towns, who chairs the House committee that will question Lewis, said he wants to ask how the Merrill transaction became "hinged on the receipt of taxpayer dollars," and how to avoid a repeat of the "financial disaster" the country has faced over the last year.

Regulators last month ordered Bank of America to raise $33.9 billion of capital as a buffer against a deep recession. Bank of America has said it raised nearly all of that sum.

Bank of America shares closed down 1 cent to $11.86 on the New York Stock Exchange. ![]()