The fog of warrants

Banks can't repay TARP loans fast enough. But some fear Treasury may let banks underpay for warrants designed to let taxpayers take part in a recovery.

|

| Fed chief Ben Bernanke said TARP warrants allow the public to 'share in some' of the recent gains. |

|

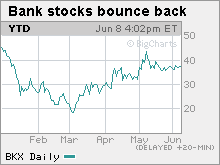

| TARP warrants could let taxpayers share in the winnings from the spring's bank-stock rebound. |

NEW YORK (Fortune) -- The big banks are back on their feet. How much credit should taxpayers get for their remarkable recovery?

That question looms over institutions such as Goldman Sachs (GS, Fortune 500), JPMorgan Chase (JPM, Fortune 500) and Morgan Stanley (MS, Fortune 500) as they seek to repay their obligations under the Troubled Asset Relief Program. Regulators on Tuesday gave 10 big banks clearance to repay $68 billion in TARP loans.

The flow of funds back into Treasury coffers from Wall Street will be a welcome sight amid worries about soaring government spending. JPMorgan Chase got $25 billion in October, when TARP was first rolled out, and Goldman and Morgan Stanley each received $10 billion.

"It's in taxpayers' interest to get these loans repaid," said Linus Wilson, an assistant finance professor at the University of Louisiana at Lafayette. He cites research that shows that selling common stock -- as the three giant firms have done over the past month -- enables banks to support more lending.

But while repaying TARP loans is a no-brainer, dealing with the stock purchase warrants that the firms issued to compensate taxpayers could be messy.

The warrants give Treasury the right to buy a bank's shares within 10 years, and are to be liquidated by Treasury once a bank repays its TARP funding.

Treasury's rules give banks the right to repurchase the warrants at their fair market value. The proceeds of the sales should allow taxpayers to share in the spring's financial sector rally.

"The point of the warrants was that if things turned around and got better, that the public would share in some of that gain," Federal Reserve Chairman Ben Bernanke told the House Budget Committee last week.

But because stock prices are volatile and because the warrants last so long, pricing them is tricky. And naturally, some of the banks don't want to pay, reasoning they never asked for the money in the first place.

Jamie Dimon, JPMorgan Chase's chief executive officer, said last week Treasury should cancel some of the warrants "out of fairness."

But fairness cuts both ways. Wilson says that in the few cases in which smaller banks have repurchased their warrants, the government has been apt to let banks underpay.

He points to the cases of two smaller institutions that repaid their TARP obligations this spring, Old National Bank (ONB) of Evansville, Ind., and Sun Bancorp (SNBC) of Vineland, N.J.

Old National paid $1.2 million for warrants Wilson valued at $6.1 million, and Sun paid $2.1 million to repurchase warrants Wilson tabbed at $5.3 million. Altogether, the government has received $12 million from five banks for warrants that, using Wilson's model, were worth $20 million -- an underpayment of 40%.

He blames the rules Treasury is using for the warrant-repayment process, which he says favors banks that make lowball offers. A better arrangement, Wilson says, would be to have investors bidding on the warrants. Current Treasury rules call for that to happen only after a bank has passed on its right to repurchase the warrants from Treasury.

Treasury referred comments about the warrant repurchase process to the fact sheets posted on its Web site. It reiterated those comments in Tuesday's statement, saying that "firms that repay their preferred stock have the right to repurchase the warrants Treasury holds in their firms at fair market value."

If Treasury allows the big banks to underpay for their warrants in line with the five small banks, taxpayers could be out hundreds of millions of dollars. Wilson said the current fair market value of the warrants issued by Goldman, Morgan Stanley and JPMorgan is around $2.9 billion.

Still, there is hope the government will learn from earlier episodes. Since the big banks have committed to repaying TARP funds as soon as possible, Wilson said, managers there "have a strong incentive to reach a settlement quickly." That could strengthen Treasury's bargaining position.

Has the recession helped you? From lower debt payments to cheaper home prices, many people have actually benefited from the current downturn. If you've made out financially and want to share your story, please email steve.hargreaves@turner.com. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More