Why taxes will need to go up

Health reform can reduce the deficit, but not nearly enough to address the country's debt problem. Higher taxes and spending cuts will be needed.

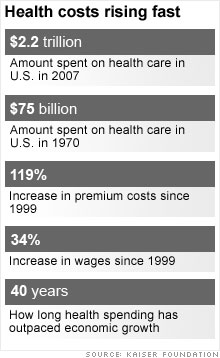

NEW YORK (CNNMoney.com) -- The promise of health reform is to make care more accessible for everybody -- and to reduce the federal deficit by slowing the growth rate in costs.

But the promise of deficit reduction through health reform might be overstated.

Here's why: Even if reform works well, the cost savings will not be nearly enough to tackle the debt ogre breathing down Uncle Sam's neck.

"Ultimately, the long-term budget outlook will necessitate serious tax and spending changes," says the Committee for a Responsible Federal Budget, which is led by tax and budget experts from the left and the right.

And "ultimately" really means ASAP, say some tax experts. That's because the financial and economic crises have exacerbated an already tough budget outlook.

"The key message is the future is now. The future has arrived," said William Gale, co-director of the Urban-Brookings Tax Policy Center, in a Brookings video discussing a sobering report on the fiscal predicament that he coauthored with Alan Auerbach, director of the Burch Center for Tax Policy and Finance at the University of California, Berkeley.

The risk is not decades from now, but within the next 10 years. Should investors in U.S. Treasurys consider the country's growing debt load to be unacceptably high, they will start demanding to be paid higher interest rates on the debt they buy to compensate them for the risk they're assuming.

That, in turn, jacks up what the country owes and increases the level of borrowing required to meet debt payments. Money available for domestic investment falls as does income growth. Meanwhile, the prospect for inflation grows should the Fed decide to print money to pay off what the country owes rather than default on its debt.

So how much can health reform help dig us out of this fiscal hole?

Budget hawks commend President Obama for insisting that health reform be deficit neutral. And they commend him for trying to tackle health costs. But the president and Congress need to do much more to put the budget on a stable footing, they say.

Best-case scenarios for health reform would reduce the growth rate in health care costs by 1.5 percentage points a year. Even Obama economic adviser Christina Romer has said that won't be easy to achieve.

Gale and Auerbach estimate that for health cost savings alone to stabilize the debt-to-GDP ratio over time, the growth rate in health costs would need to be slowed by 3 percentage points a year -- for 75 years.

"The issue is certainly health care, but the issue is a lot more than health care," Gale said. "Our fiscal books are fundamentally out of balance."

A big reason, Gale and Auerbach say, are the tax cuts and spending increases put into place since 2001.

One way to measure the imbalance is to consider the "fiscal gap" -- which is a measure of the difference between revenue and outlays over the long term.

Under Obama's budget, Gale and Auerbach estimate the fiscal gap would be 9% of GDP. Conceptually, that means to restore fiscal balance over the long-term the federal government would need to increase taxes by 9% of GDP or cut spending by that amount starting now and lasting "until the end of time," Gale said.

For some context, consider that in a normal year, the country gets tax revenue equal to about 9% of GDP.

Obama has promised to make permanent the tax cuts for everyone except high-income households. It's an expensive promise. The federal coffers will see roughly $2.1 trillion less in revenue over the next 10 years than it would if the tax cuts expired for everyone, according to estimates from the Joint Committee on Taxation.

"The [Obama administration] gave away a huge pot of money. [It was] a gargantuan missed opportunity," said Charles Konigsberg, chief budget counsel of the Concord Coalition, a deficit watchdog group.

Currently lawmakers are contorting themselves trying to figure out ways to pay for health reform so it doesn't increase the deficit and doesn't alienate their constituents ... too much.

But the pay-for debate over health care will be a mere warm-up to the resistance Congress will face if it tries to put the budget on more stable footing.

Politicians understand the issue behind closed doors, Gale said. But when they're in front of the cameras, he noted, "Republicans say 'no new taxes.' And Democrats say 'no new taxes for 95% of all households.' Neither one of those is a starting position for sensible fiscal reform."

None of this means the country shouldn't embark on health reform. But it does mean lawmakers will have to level with the public. And the public -- which itself is no big fan of tax hikes and spending cuts -- will have to listen.

Without making significant changes to lessen the country's debt burden, the Committee for a Responsible Federal Budget said, "we face the real threat of a fiscal and economic crisis more severe than what we've already endured." ![]()