Morgan Stanley posts another loss

The white shoe Wall Street firm continues to struggle with red ink as rivals such as Goldman Sachs pile up profits.

|

| CEO John Mack is still looking to solve Morgan Stanley's problems. |

|

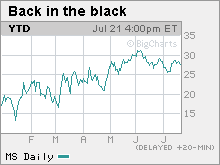

| Morgan Stanley shares have risen this year but remain well below their 2007 peak. |

NEW YORK (Fortune) -- Morgan Stanley posted its third straight quarterly loss Wednesday, as the brokerage firm struggles to bounce back from last fall's market meltdown.

New York-based Morgan Stanley (MS, Fortune 500) lost $1.26 billion in the quarter ended last month, with a big chunk of that loss due to a one-time expense tied to paying back the government loan it received last fall.

The second quarter loss compares with a year-ago profit of $1.06 billion, or $1.02 a share a year ago.

The company said that its net loss from continuing operations was $159 million, or $1.37 a share. Analysts surveyed by Thomson Reuters were looking for a 49-cent loss.

In a statement, Morgan Stanley said that there was some improvement in its key investment banking and wealth management businesses. But chairman and chief executive officer John Mack added that the company is "not satisfied with our performance in other key areas of fixed income trading and in asset management, and we are taking steps to deliver better results in those businesses."

On a conference call with analysts and investors, Morgan Stanley chief financial officer Colm Kelleher said the firm had "punched below its weight" in its trading businesses.

The company's core securities business swung to a $307 million pretax loss from a year-ago profit of $844 million, as equity sales and trading revenue dropped 69% from a year earlier.

Morgan Stanley's asset management unit showed a pretax loss of $239 million, compared with a $232 million loss last year. The firm said assets under management have dropped 38% over the past year, reflecting the decline in stock market values and $122 billion of net customer outflows, mostly from money market and fixed-income funds.

Morgan Stanley said the latest period's results were also hit by costs tied to repaying the money it got as part of the government's Troubled Asset Relief Program and, for the second straight quarter, by a writedown driven by the improvement in the company's credit spreads. Mack, in a replay of his remarks last quarter, said the firm would have been profitable if not for those costs.

But shares of Morgan Stanley slipped in trading Wednesday, as the firm falls behind its rivals in staging a recovery from last fall's near death experience.

"Debt valuation adjustments were larger than we expected and costs related to TARP repayment and real estate related losses offset improved trading and underwriting results," Standard & Poor's equity research analyst Matthew Albrecht wrote in a note to clients.

Albrecht said he believes Morgan Stanley "is positioned to take market share in its investment banking and wealth management businesses, but asset management results continue to lag."

The results stand in contrast to gaudy profit reports last week from Goldman Sachs (GS, Fortune 500) and other banking rivals. Goldman set aside more than $6 billion in the first half of 2009 for employee pay, in line with its payouts at the height of the credit bubble.

Those numbers raised eyebrows because like Morgan Stanley, Goldman survived last fall's market collapse only with considerable help from taxpayers. Both firms got $10 billion in loans from the Treasury Department and became bank holding companies for the sake of gaining access to emergency lending from the Federal Reserve.

Accordingly, some observers see Goldman's massive profits coming out of the hide of taxpayers at a time when the economy continues to struggle.

That criticism isn't likely to be an immediate problem for Morgan Stanley, which has now lost nearly $3 billion over the past three quarters, excluding payments on preferred dividends.

The second quarter caps off a period in which Morgan Stanley raised $6.9 billion in new equity to shore up its balance sheet and clear the way to repay its government borrowings. The bank repaid its Troubled Asset Relief Program loan in June.

Morgan Stanley also closed on its agreement to set up a joint venture with Citigroup's (C, Fortune 500) Smith Barney wealth management arm during the quarter. Kelleher said on Wednesday's call that the firm is "slightly more pleased" with the progress of that arrangement than it had expected, though he declined to offer detailed financial forecasts for the newly named Morgan Stanley Smith Barney division.

The capital raising and a pullback from some risky bets have fortified Morgan Stanley's balance sheet. But now that financial markets are showing some signs of normalizing and peers such as Goldman and JPMorgan Chase (JPM, Fortune 500) are pulling in huge trading profits, some observers say Morgan Stanley needs to show it can keep pace.

"Investors are understandably concerned that the government's zeal in requiring the company to raise capital will result in real difficulty" in generating adequate returns, Bank of America Merrill Lynch analyst Guy Moszkowski wrote last month.

Morgan Stanley shares have rebounded sharply from last year's woes, rising more than 75% so far this year. But the stock fell about 1% in midday trading Wednesday. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More