Stocks end with a flourish

Wall Street rallies into the close, with bank and tech stocks rising after a 3-day selloff.

|

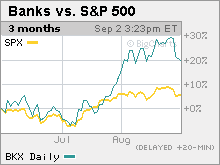

| The KBW Bank index gained 20% this summer, while the S&P 500 gained 11%. |

|

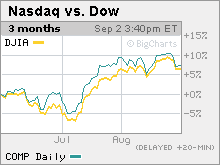

| The Nasdaq rose 13.2% in the June through August period while the Dow gained 11.7%. |

NEW YORK (CNNMoney.com) -- Wall Street staged a late-session rally Thursday, as investors piled into bank and technology shares following a three-day selloff on worries about the health of the economy.

The Dow Jones industrial average (INDU) gained 64 points, or 0.7%. The S&P 500 (SPX) index added 8 points, or 0.9%. The Nasdaq composite (COMP) rose 16 points, or 0.8%.

Stocks drifted higher through most of the session as financials and other stocks that were hit earlier in the week bounced back. But the advance was limited by tepid back-to-school sales from the nation's retailers and a troubling weekly jobless claims report, ahead of the bigger non-farm payrolls report Friday.

"The key fundamental investors are looking for is continual improvement in the jobs market, and today's jobs numbers weren't very positive," said Robert Siewert, portfolio manager at Glenmede.

The August report from the Labor Department is due before the start of trading Friday. Employers are expected to have cut 225,000 jobs from their payrolls in August, according to economists surveyed by Briefing.com. Employers cut 247,000 jobs in July. The unemployment rate, generated by a separate survey, is expected to have risen to 9.5% from 9.4% in July.

Also on Friday, Treasury Secretary Timothy Geithner meets with the G-20 Finance ministers in London.

Trading volume is likely to be light and markets could be particularly volatile ahead of the three-day Labor Day holiday.

Rally hits roadblock: Stocks have slid the past three sessions, after ending last week at 2009 highs. The S&P 500 and Nasdaq both ended last week at levels not seen since just after the collapse of Lehman Bros. last September.

But this week has brought persistent selling on worries that the rally has gotten way ahead of any recovery. That weakness has been compounded by lighter-than-usual trading ahead of the Labor Day holiday weekend.

As much as there is an argument for a pronounced selloff as the seasonally tough September heats up, there is also an argument for a continued slow build higher, said Larry Glazer, managing director at Mayflower Advisors.

"Traders are dominating while the retail investors have for the most part remained skeptical and not really gotten back in yet," he said. That could change if more economic news in the weeks ahead continues the argument for a recovery, he said.

Financials: The bank sector was traded most heavily last week, in terms of both volume and momentum, and it also led the retreat earlier this week.

"Last week we got into a speculative frenzy on the trader's side with Citigroup, Fannie Mae and AIG some of the most active names," Glazer said. "This week, those stocks led the decline."

But by Thursday afternoon, the selling had eased up and financial shares were charging ahead again. Major Dow financials Bank of America (BAC, Fortune 500), American Express (AXP, Fortune 500) and JPMorgan Chase (JPM, Fortune 500) rose, too. The KBW Bank index gained 2.5%.

Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500) both continued their recent surge. The stocks got an extra boost after the New York Federal Reserve Bank said it bought $3.779 billion of U.S. agency debt, bringing its total to $122.4 billion in the last 9 months. The Fed has said it will buy $200 billion in debt from Fannie, Freddie and the Federal Loan Bank System as part of its efforts to keep mortgage rates low and help the economy recover.

Economy: A worse-than-expected jobless claims report and a mix of retail sales added to concerns about the health of the consumer. With consumer spending traditionally fueling two-thirds of economic growth, investors are looking for signs that spending could be picking up.

But with layoffs continuing to grow, consumers have been hunkering down and boosting savings.

The number of Americans filing new claims for unemployment last week stood at 570,000, a decline from the previous week's 574,000, but only because the previous week's numbers were revised higher. Economists surveyed by Briefing.com were expecting 564,000 new claims.

Additionally, continuing claims, a measure of people who have been filing claims for a week or more, rose 92,000 to 6.23 million, topping forecasts for a rise to 6.12 million.

The Institute for Supply Management's services sector index for August rose to 48.4 from 46.4 previously. Economists thought it would rise to 48. Any number below 50 implies the sector is continuing to weaken.

Retail: Back-to-school sales for the nation's retailers were weaker than a year ago, but results still topped analysts' forecasts. August same-store sales, or sales at stores open a year or more, fell 2.9% versus a year ago, according to Thomson Reuters. Analysts expected sales to drop 3.8%.

Discounters did the best, including clothing retailer Aeropostale (ARO), which said sales rose 9% versus forecasts for a jump of 7.1%.

Target (TGT, Fortune 500) said sales fell 2.9%, versus analysts' bets that sales would drop 5.1%. Costco (COST, Fortune 500) and Limited Brands (LTD, Fortune 500), which owns Bath & Body Works, reported weaker sales that surpassed forecasts.

Abercrombie & Fitch (ANF) said sales plunged 29% versus a year ago.

Company news: Dainippon Sumitomo Pharma of Japan is buying U.S. drugmaker Sepracor (SEPR) for about 2.6 billion, the companies said Thursday, confirming earlier reports.

Along with financial components, Caterpillar (CAT, Fortune 500) and GE (GE, Fortune 500) were among the stocks boosting the Dow.

But selling in components Merck (MRK, Fortune 500), Coca-Cola (KO, Fortune 500), AT&T (T, Fortune 500) and IBM (IBM, Fortune 500) put a limit on any gains.

Oil and gold: U.S. light crude oil for October delivery fell 9 cents to settle at $67.96 a barrel on the New York Mercantile Exchange. Oil prices have been slipping since hitting a 10-month high just below $75 a barrel late last month.

COMEX gold for December delivery rose $19.20 to settle at $997.70 an ounce, inching closer to the psychologically significant $1,000 level.

World markets: Global markets recovered, with major European markets mostly ending higher. Most Asian markets ended higher, with the exception of the Japanese Nikkei. China's main index, the Shanghai Composite, added 5%.

Bonds and currency: Treasury prices slipped, raising the yield on the benchmark 10-year note to 3.32% from 3.30% late Wednesday. Treasury prices and yields move in opposite directions.

In currency trading, the dollar fell versus the euro and the Japanese yen.

How does your portfolio look nearly one year after the collapse of Lehman Brothers? What investment choices hurt you or helped you the most? What strategy changes are you making for the future? Tell us your story. E-mail realstories@cnnmoney.com and your thoughts could be part of an upcoming story. For the CNNMoney.com Comment Policy, click here. ![]()