Malls think outside the (big) box

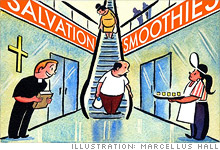

In a dismal retail climate, developers are luring unconventional tenants.

NEW YORK (Fortune) -- A freeze in consumer spending, abysmal same-store sales, and a swath of retail bankruptcies have taken a serious toll on your local mall.

Nationwide, mall vacancy rates hover at 8.4%, their highest level since commercial real estate research firm REIS started collecting the data almost a decade ago. To keep their storefronts full, mall operators are starting to get creative when it comes to their definition of a tenant.

At Concord Mall in Elkhart, Ind., a 4,900-square-foot space formerly occupied by KB Toys sat basically vacant for more than four years until the evangelical Fresh Start Church moved in. Located right next to Jo-Ann fabrics, the church has seating for 150 and is known for its frequently changing window displays.

The mall's retailers might not see a noticeable increase in sales since the church moved in, but mall manager Robert Thatcher and Fresh Start's Pastor Rick Harris (a.k.a. the "Mall Pastor") say the food court's business is up; members of the congregation tend to grab a bite on Sundays after church lets out.

In Nashville, Tenn., One Hundred Oaks Mall welcomed a new kind of tenant in February: the Vanderbilt Medical Center, a sprawling facility that, at 436,000 square feet, takes up almost half the mall.

When owner Tony Ruggeri and a partner bought the space in 2006 the mall faced a dire 55% vacancy rate with a second floor that was virtually dead. Now the health care facility, which had its main opening in February, brings in almost 1,000 employees and just as many patients every day.

And when Crestwood Court in St. Louis lost Macy's (M, Fortune 500) earlier this year, rather than try to find another anchor tenant it did the same thing it did when Dillard's (DDS, Fortune 500) vacated two years ago: it turned the empty space in its wing into an artists' colony until it can renovate. Local artists can rent these empty storefronts -- turning them into a dance studio and theater, for instance -- at a seriously discounted rate.

Crestwood mall operator Jones Lang LaSalle says business at restaurants picks up when the theater is putting on a show, and stores like Children's Place (PLCE) see more traffic from parents when their kids are in dance lessons.

All told, at least 63 churches, 244 medical facilities, and 172 schools moved into retail space in the second quarter of 2009 alone, according to CoStar Group.

The motto of the moment is "tenant retention," says retail real estate consultant Steven Greenberg. Mall operators are also doing whatever they can to keep existing tenants in place, like agreeing to shorter leases and rent relief. (Asking rent for non-anchor tenants is down 3% from a year ago, says research firm REIS.) In some cases they're accepting regional retailers and nontraditional mall stores like Costco (COST, Fortune 500).

Critics say some of these alternative uses may fill space, but they don't help the customer experience. William Taubman, the COO of mall REIT Taubman Centers (TCO) (son of company founder A. Alfred Taubman, who was convicted in 2001 of price fixing while chairman of Sotheby's) says the company left a space next to a Louis Vuitton store at its Beverly Center property in Los Angeles vacant for two years rather than fill it with just any tenant.

"Customers come to the mall to eat and to shop and to hang out," he says. "Uses more tangential to that are really not as productive."

That may be so for Taubman Centers, which owns some of the most coveted malls around the U.S. But for others, putting church pews next to the food court may be the only way to stay alive. ![]()

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More