Lend to family the right way

A loan to a relative can actually be a sweet deal for both sides, if it's served up correctly.

(Money Magazine) -- When Brian Hetherington complained to his father two years ago about the weighty 9% rate he and his wife were paying on their home-equity line of credit, Jim, the senior Hetherington, had an idea. He could lend the couple the $100,000 to pay off the loan and charge them only 6%. It's been win-win ever since. "We haven't missed a payment," says Brian, 43. And his folks are still earning a return on their money.

With banks stingier in the credit they're offering to borrowers, families are finding that it pays to cut traditional financial institutions out of the equation. While the bulk of interpersonal lending is informal and hard to track, there's clearly a lot of money moving around. At Virgin Money, an online company that facilitates such loans, volume has more than doubled in two years, to $425 million.

Perhaps you're considering helping an adult child buy a first home, aiding a sibling who is struggling with debt, or supporting a relative who's lost a job. Those are laudable objectives, but beware before putting up serious money.

"Lending to family can be dangerous," says Dennis Stearns, a Greensboro, N.C., financial planner who has seen deadbeat relatives and bad communication doom deals and damage relationships.

In fact, according to a recent Money survey, 43% of readers who lent to family or friends weren't paid back in full; 27% hadn't received a dime. To avoid joining this unfortunate club, follow these steps before offering an advance.

Check your reserves. The arrangement can go wrong on either end. On your side, you want to be sure of two things. First, that if the loan falls through, it won't destroy a cherished relationship. And that you can truly afford to give up the money being requested.

The emotional part is for you alone to judge; we'll stick to the practical side of the equation. To start, verify that the loan won't jeopardize your retirement. Use T. Rowe Price's retirement income calculator to see if you'd be able to manage comfortably if the money isn't repaid. You also shouldn't play banker if it means taking on debt or selling assets you're not prepared to sell -- especially if the latter would trigger capital gains taxes.

Even if you can swing the loan, be sure your immediate family is onboard. Troubles can arise if you want to make the deal and your spouse doesn't. If you're lending to your child, bring his or her siblings into the loop; a big loan to one could reduce funds available to the others or be seen as favoritism.

Vet the borrower. On the other side, you must consider the likelihood that the borrower will pay you back. You probably already have a sense of whether he or she is a good risk, based on past behavior. But go a step further. Request that the person produce a credit score and report so you can see how she has managed other loans (look for late payments and delinquencies).

"And ask for a debt-repayment plan," says Burt Hutchinson, a Lewes, Del., financial planner. This will help you see if the borrower is willing to take this arrangement seriously. Also, if it's a loan for a business, make sure you get a copy of the business plan.

Definitely don't lend out of guilt. If the person appears to be a bad risk, "just say, my financial adviser is telling me I can't afford to do this," says Hutchinson. Lessen the sting with an offer of nonfinancial help -- such as babysitting -- so the would-be borrower can work longer hours.

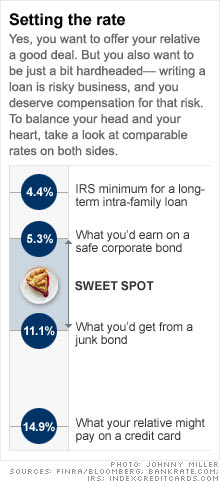

Set your terms. Families often low-ball the interest rate on personal loans, but if you go too low, you can run afoul of Internal Revenue Service rules -- of which there are many. For starters, you're supposed to declare and pay tax on the interest earned. If the loan is over $10,000, you owe tax on at least a minimum rate, even if you don't collect. The IRS posts what it calls the applicable federal rates on its website.

In September the rates were 0.84% for a loan of less than three years; 2.87% for three to nine years; and 4.38% for any loan over nine years. If you don't declare the interest on your taxes, the loan could be considered a ploy to avoid gift or estate taxes, and that's a whole other headache, says Michael Yuen, a Rockville, Md., CPA and financial planner.

Set the repayment schedule with the borrower, and finally, make it clear what rights you have as lender. If you're bailing out a debt-ridden child, for example, you may want to stipulate how she spends her money until you're paid back.

Write it up. It pays to have a paper trail, for both IRS purposes and your own. Putting the agreement in writing emphasizes that this is a business arrangement.

You can opt to have a third party administer the loan for you. Or use a fill-in-the-blanks promissory note. Include the amount borrowed, the interest rate, and the repayment schedule. Sign it in front of witnesses. And seal with a kiss if you'd like. ![]()