Stocks shake off jitters to end higher

Markets stage slim advance after a choppy morning as Wall Street weighs Obama speech and eyes China trade dispute.

|

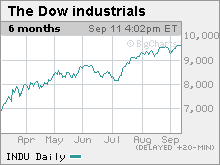

| The Dow Jones industrial average has gained 47% since the March 9 bottom. |

|

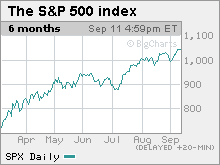

| The S&P 500 has gained 54% since March 9. |

|

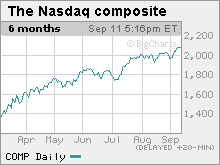

| The Nasdaq has gained 64% since the March 9 bottom. |

NEW YORK (CNNMoney.com) -- Stocks ended higher Monday as investors ultimately shook off the day's jitters about China's trade rift with the U.S. just ahead of the anniversary of the collapse of Lehman Brothers.

The Dow Jones industrial average (INDU) gained 21 points, or 0.2%. The S&P 500 (SPX) index gained 6 points, or 0.6%. The Nasdaq composite (COMP) gained 11 points, or 0.5%.

Stocks took a breather Friday after a five-session winning streak that left the major indexes at the highest levels in nearly a year. But after that selloff, investors were wary Monday. A choppy session ended with only slim gains.

Higher commodity prices have supported the most recent leg of the advance, boosting the underlying stocks. Gains in technology and financial shares added to the advance.

But oil services, tech and financial shares struggled Monday, limiting the market's movement.

Tuesday brings the August retail sales report from the Commerce Department and, the Producer Price index (PPI), a measure of wholesale inflation, and the Empire State manufacturing index.

China: The U.S. and its largest trading partner are facing a growing rift, even as the countries continue to collaborate as part of a global effort to tackle the economic slowdown.

Late Friday, President Obama, responding to complaints from labor unions, said the U.S. would impose tariffs of up to 35% on tires from China.

On Sunday, China said it would begin the process of imposing tariffs on U.S. cars and chicken meat. On Monday, China asked the World Trade Organization to get involved.

The conflict precedes the Group of 20 meeting of leaders of the largest and fastest-growing economies in the U.S. next week.

Global markets tumbled, with major European and Asian markets ending lower.

The trade spat and slide in global markets gave a boost to the U.S. dollar, which has been sliding versus other major currencies lately.

President Obama: The president spoke Monday on Wall Street about financial services reform on the eve of the one-year anniversary of the collapse of Lehman Brothers.

Obama said that the economy is returning to normal, but that it will take time. He also said Wall Street must take steps to rebuild its relationship with the public and make sure that it doesn't engage again in the kind of behavior that led to the crisis.

One-year later: Tuesday is the anniversary of the collapse of Lehman Brothers and buyout of Merrill Lynch by Bank of America, events that were seen as turning a recession into a full-blown crisis on a level not seen since the 1930s.

On that day, the Dow plunged 504 points as financial shares tumbled, credit seized up and investors panicked.

Stocks zigzagged through the week, but managed to end with just slim declines that Friday thanks to some government actions. They included the Fed jumping in to save AIG (AIG, Fortune 500) from bankruptcy and the establishment of an early version of the TARP bank bailout plan.

For a look at what the government has been doing over the last year to manage the crisis, click here.

Company news: Eli Lilly (LLY, Fortune 500) said its cutting around 5,500 jobs as part of a bigger plan to save $1 billion by 2011. Shares ended modestly higher.

Sprint (S, Fortune 500) shares rallied 11% on published reports that Deutsche Telekom, the owner of T-Mobile USA, is interesting in acquiring the U.S. based phone carrier.

Oil and gold: The stronger dollar dragged on dollar-traded commodities Monday, with oil and gold prices retreating.

U.S. light crude oil for October delivery fell 43 cents to settle at $68.86 a barrel on the New York Mercantile Exchange.

COMEX gold for December delivery fell $5.30 to settle at $1,001.10 an ounce, remaining above the key $1,000 level.

Bonds: Treasury prices fell, raising the yield on the benchmark 10-year note to 3.38% from 3.35% late Friday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners beat losers two to one on volume of 1.21 billion shares. On the Nasdaq, advancers beat decliners eight to five on volume of 2.19 billion shares. ![]()

Ranking the rescues

Fighting off the Bear: Seven stories

Big week on Wall Street

Rx for money woes: Doctors quit medicine

5 lessons from the crash

50 Most Powerful Women

Holler if you like the dollar. Anyone?

Wells Fargo: Good bank or bad bank?

Bernanke: Fed's unlikely risk taker

100 Fastest-growing companies

50 years of profit swings