Baby-proofing the family finances

Too much company stock (and maybe travel) is keeping the Grant's portfolio from going places.

|

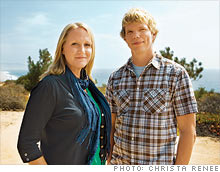

| Stephanie and Chad Grant, San Diego |

| MMA | 0.69% |

| $10K MMA | 0.42% |

| 6 month CD | 0.94% |

| 1 yr CD | 1.49% |

| 5 yr CD | 1.93% |

(Money Magazine) -- After seven years of marriage, Stephanie and Chad Grant are about ready to start a family. Before they do, the 31-year-olds want to baby-proof their finances.

That means dialing down risk in their company-stock-laden portfolio and in general "balancing our investments to meet short- and long-term goals," says Stephanie. The couple also need a savings plan.

It's not as if the Grants don't sock away money now. Stephanie, in public relations, and Chad, a biomedical engineer, have more than $200,000 invested in a mix of retirement and taxable accounts.

But they have just $8,500 set aside in cash for emergencies. The Grants don't spend lavishly on day-to-day items, but they do devote $20,000 or so a year to travel. They know that will have to change once they have kids.

1. Sell company stock. More than half their portfolio is in Chad's company stock and options. That's especially risky since he works for a small medical-device firm. Financial adviser Jon Beyrer in Solana Beach, Calif., tells the Grants to trim this by $88,000, bringing their exposure below 20%.

2. Create a cash plan. Use some of the stock-sale proceeds to build a six-month emergency fund. A quarter of the $48,000 they need belongs in a savings account; the rest can go into a safe bond fund. They should also keep cash in separate accounts, so they'll never pay for travel with money set aside for emergencies or planned expenses.

3. Fix their mix. Because of their heavy dose of employer stock, the Grants' portfolio is concentrated in small-cap U.S. shares. To diversify, they need to boost their stake in bonds and foreign stock funds.

Want a Money Makeover? E-mail us at makeover@moneymail.com. ![]()