The secret to Jamie Dimon's luster

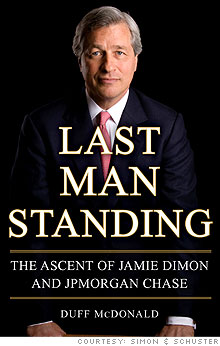

Journalist Duff McDonald's new book, 'Last Man Standing,' takes a fresh look at the megabank CEO for our times.

WASHINGTON (Fortune) -- It's hard for a banker to get much love these days -- unless his name is Jamie Dimon, in which case he's hailed as the hero of his industry.

The 53-year-old CEO of JPMorgan Chase gets a thorough biographical treatment, and more praise, in the new book Last Man Standing: The Ascent of Jamie Dimon and JPMorgan Chase by journalist Duff McDonald.

Dimon and his family and friends opened up to McDonald in dozens of interviews, and it shows in the richness of the portrait. The shorthand description of Dimon has long been that he's a ruthless number-cruncher.

Here, McDonald fleshes that out considerably, portraying Dimon as a perfect megabank CEO for these times: He's attuned to risk -- in 2006 he yanked the company out of more than $12 billion subprime mortgages it had originated -- and he leads his employees with a sensitive moral gut. He also has a lifelong habit of mouthing off to authority (Citigroup's Sandy Weill being the most famous recipient, but certainly not the first.)

McDonald starts by digging into the Dimon family tree -- and finds a classic American immigrant story. Dimon's paternal grandfather was a Greek immigrant who shortened the family name from Papademetriou to Dimon, because the latter sounded French. After he was fired from a job as a bus boy, Jamie's grandfather started working at a branch of the Bank of Athens. And so the Dimon family's penchant for banking was born.

Dimon's independent streak surfaces early on. At the Browning School on Manhattan's Upper East Side, Dimon asserted himself against teachers constantly. In one striking anecdote, the only African American student in the class was asked to leave after misbehaving, prompting the teacher to say, "Six hundred thousand died to free the slaves, and this is the gratitude we get." Dimon took his things and walked out.

Later, when Dimon worked for a small firm in Boston called Management Advisory and Consulting, a partner assigned him a project to finish over the weekend. When the partner didn't show up to see Dimon's work on Monday morning, Dimon confronted him. Dimon told the partner his weekend had been ruined, adding, "And because of that, I will never work on another project for you again." Others at the company told Dimon he couldn't say such things. "Yes, I can," he responded. "And they can fire me if they want to."

This brashness contributed to the famous falling out between Dimon and his mentor Sandy Weill. In 1998, soon after Weill and Dimon pulled off the merger between Citicorp and Travelers, Dimon was fired, and observers ever since have been wondering what might have been if Dimon had stayed to run Citi (C, Fortune 500). McDonald quotes Richard Bookstaber, author of Demon of Our Own Design, who puts the firing up there with Time Warner's merger with AOL in the annals of disastrous business decisions. "[Weill firing Dimon] probably cost $200 to $300 billion. It's pretty amazing."

Ten years later, toss in a major financial crisis, and these two men who once forged their careers together are watching their legacies transform. Weill's vision for Citi is not panning out, while Dimon has emerged a hero following JPMorgan Chase's takeover of Bear Stearns and purchase of Washington Mutual's assets.

Here again McDonald portrays Dimon as a man very much in control of the situation last fall. The book reveals that at one point early last September, Treasury Secretary Hank Paulson called Dimon and told him he could acquire Morgan Stanley for nothing. Dimon immediately said no; there was too much overlap between the banks and JPMorgan (JPM, Fortune 500) already had its hands full with Bear Stearns.

And that's the sort of steel that makes it no surprise that, while Weill chose to write a memoir in 2006 -- The Real Deal -- to defend his side, Dimon let a journalist in to tell this story. ![]()

Jamie Dimon vs. Sandy Weill

When a bank feud got physical

-

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More

The retail giant tops the Fortune 500 for the second year in a row. Who else made the list? More -

This group of companies is all about social networking to connect with their customers. More

This group of companies is all about social networking to connect with their customers. More -

The fight over the cholesterol medication is keeping a generic version from hitting the market. More

The fight over the cholesterol medication is keeping a generic version from hitting the market. More -

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More

Bin Laden may be dead, but the terrorist group he led doesn't need his money. More -

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More

U.S. real estate might be a mess, but in other parts of the world, home prices are jumping. More -

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More

Libya's output is a fraction of global production, but it's crucial to the nation's economy. More -

Once rates start to rise, things could get ugly fast for our neighbors to the north. More

Once rates start to rise, things could get ugly fast for our neighbors to the north. More