Stocks struggle at quarter end

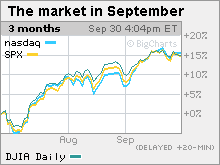

The Dow, Nasdaq and S&P 500 waver in final moments of the third quarter, but still end 15% higher. Weaker-than-expected reports on employment and manufacturing are in focus.

NEW YORK (CNNMoney.com) -- Stocks inched lower Wednesday, following weaker-than-expected readings on manufacturing and the labor market. But the declines were minimal at the end of an upbeat month and quarter on Wall Street.

The Dow Jones industrial average (INDU) fell 30 points, or 0.3%. The S&P 500 (SPX) index lost 3 points, or 0.3%. The Nasdaq composite (COMP) lost just over 1 point, or 0.1%.

Stocks were volatile throughout the session as investors considered the economic news, a weaker dollar and a 6% spike in oil prices. End-of-quarter portfolio rebalancing on the part of investors and fund managers may have contributed to the volatility.

Wednesday was the last day of the third quarter, during which the Dow, S&P 500 and Nasdaq all gained just over 15%.

Stocks slipped Tuesday after a drop in consumer confidence added to worries about the sustainability of an economic recovery.

Since bottoming at a 12-year low March 9, the S&P 500 has gained just shy of 57%, and the Dow has gained around 49% (as of Tuesday's close). After hitting a six-year low, the Nasdaq has gained nearly 68%.

In addition, "there's still so much money on the sidelines that equity investors are using any selloffs to get back in," said Jane Caron, chief economic strategist at Dwight Asset Management.

Bank of America (BAC, Fortune 500) said after the close that CEO and president Ken Lewis is retiring on Dec. 31 after 40 years with the company.

Also after the close, General Motors said it is shutting down its Saturn division after a deal to sell it to Penske Automotive Group (PAG, Fortune 500) fell apart.

Economy: The Chicago PMI fell to 46.1 in September from 50 in August. Economists surveyed by Briefing.com thought it would rise to 52. A reading below 50 signifies contraction in the manufacturing sector.

Another report showed that employers in the private sector cut 254,000 jobs from their payrolls in September after cutting a revised 277,000 jobs in August. Economists expected 200,000 job cuts. The report, from payroll services firm ADP, is a lead up to Thursday's reading on announced jobs cuts and Friday's bigger government employment report.

While the jobs report could be a harbinger of Friday's bigger government jobs report, the manufacturing report is not consistently accurate, Caron said.

"We've seen a spate of reports over the last few weeks that have been disappointing relative to consensus, but it's been nothing that really alters the economic outlook," Caron said.

She said that rather than suggesting that the recovery is losing steam, the reports suggest that after months of improving data, economists have started boosting estimates.

A third report showed GDP shrank at a 0.7% annual rate in the second quarter versus the initially reported 1% and the 1.2% rate forecast by economists.

Companies: CIT Group (CIT, Fortune 500) sank 45% on worries that it may not be able to avoid bankruptcy after all.

The lender's shares rallied Tuesday on reports that it was negotiating a new credit facility that could total $10 billion.

On Wednesday, the Wall Street Journal said that CIT was negotiating a deal with its creditors that would give control of the company to bondholders and wipe out common shareholders. That sent shares tumbling.

Among other movers, shares of Discovery Laboratories (DSCO) surged 22.5% on renewed hopes that its treatment for certain respiratory illnesses affecting premature infants might get approval. The drug, Surfaxin, has already been rejected four times by the FDA. But on Wednesday, Discovery said that the FDA has agreed to its proposed plan for addressing those concerns.

Boeing (BA, Fortune 500), Caterpillar (CAT, Fortune 500), JPMorgan Chase (JPM, Fortune 500), Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) were among the Dow's losers. Chevron and Exxon dipped despite a rise in oil prices.

Market breadth was negative. On the New York Stock Exchange, losers beat winners four to three on volume of 1.77 billion shares. On the Nasdaq, decliners topped advancers eight to five on volume of 2.75 billion shares.

World markets: Global markets were mixed. In Europe, London's FTSE 100, France's CAC 40 and Germany's DAX all ended lower. In Asia, the Hong Kong Hang Seng fell and the Japanese Nikkei rose.

Currency and commodities: The dollar fell versus the euro and yen, resuming the selloff that has pushed the U.S. currency to one-year lows against a basket of currencies over the last few weeks.

U.S. light crude oil for October delivery rose $3.90 to settle at $70.61 a barrel on the New York Mercantile Exchange after the government reported a surprise drop in inventories.

COMEX gold for December delivery rose $14.90 to settle at $1009.30 an ounce. Gold closed at a record high of $1,020.20 two weeks ago.

Bonds: Treasury prices slumped, raising the yield on the benchmark 10-year note to 3.30% from 3.29% late Tuesday. Treasury prices and yields move in opposite directions. ![]()