Bailout cop on the prowl for perps

Neil Barofsky's job is to root out fraud in the $700 billion rescue program. So far, he has put only one bad guy behind bars. But he says: Stay tuned.

|

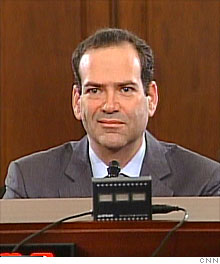

| TARP cop Neil Barofsky has a new audit due out in coming weeks on the first 9 bailouts. |

WASHINGTON (CNNMoney.com) -- Bailout cop Neil Barofsky is on the lookout for scammers and thieves.

The special inspector general will soon release results of an audit of the money given to the nine largest banks, with a focus on the Bank of America-Merrill Lynch merger. He's also involved in a criminal investigation into that merger.

In addition, Barofsky is investigating a now-defunct Alabama bank that applied for but never received bailout funds under the Troubled Asset Relief Program.

In all, he has 35 ongoing criminal and civil investigations underway.

But if you measure an investigator's success by notches in his gunbelt, Barofsky has a ways to go. His biggest win came in August, when he helped put behind bars for 10 years an investment manager who conned investors into buying "TARP-backed securities."

Barofsky is not worried about counting wins. His team is going after complex cases like securities and accounting fraud, even if indictments are years away.

"The cases most important to our mission are those where we investigate those who try to steal money from Treasury," Barofsky said in an interview with CNNMoney.com. "But that means they're complex and take awhile."

And he has time for in-depth investigations. His office, which was established by the 2008 bailout law, exists as long as the Treasury Department still owns assets paid with TARP dollars. Even as new funding winds down next year, some TARP programs are expected to own assets for another 8 to 10 years.

Barofsky is one of several watchdogs lurking over the $700 billion federal bailout program.

"At SigTARP, they really do carry a gun and a badge," said Elizabeth Warren, chairwoman of Congressional Oversight Panel, which also oversees the bailout. "They audit the books. They make sure that when a check has been made out to the First National Banks of Sallisaw, Oklahoma, that it really got cashed and the money went into that bank's coffers."

Warren's panel looks at policy and big picture questions about how taxpayer dollars are spent and whether they're helping the economy.

Barofsky's job is different. He focuses on fraud. Yet, he says the loose nature of the TARP law gives banks leeway in how they use the funds that wouldn't be considered fraud.

"They're so few conditions on how they can use the money," he said. "They could use it to support ACORN. They could use it to make a million-dollar contribution to the American Nazi Party or bet all the money on black."

Barofsky is looking beyond the banks that have received funding and is probing companies that may have lied on their bailout applications or used the TARP name to rip off consumers.

"If those numbers are cooked, then there's accounting fraud going on, and there is securities fraud going on, that's a large part of our work," he said.

Barofsky, 39, a former federal prosecutor from New York, was tapped as bailout overseer by President George W. Bush last December.

His ultimate boss is President Obama, who has the power to dismiss him.

But, unlike most federal inspectors general, Barofsky reports to Congress and not the head of the agency he reviews. Treasury had challenged the question of who Barofsky reports to until dropping the issue in late August.

"You can never rest on your laurels," Barofsky said about his apparent victory in affirming his office's independence. "This challenge has been met and turned away, but we need to stay vigilant."

The question of SigTARP's independence was only the latest of several awkward moments between Treasury and SigTARP, although both sides maintain they have a cordial and professional relationship.

In July, Barofsky made headlines when he said that $23.7 trillion had been committed for all federal rescue programs. Republicans seized on the number and redoubled their criticisms of the TARP-keepers in the Obama administration.

Treasury officials said the figure was inflated. Indeed, Barofsky's calculation included several programs that the government is no longer on the hook for, as well as bailouts that banks paid back. But Barofsky stood by his figure.

A more nuanced punch, counter-punch happened again last week before the Senate Banking Committee over what Barofsky called Treasury's "great failing" -- its lack of transparency in how it's handling TARP.

Treasury's TARP chief, Herb Allison, told lawmakers that the department had implemented the "vast majority" of recommendations made by Barofsky and other watchdogs about reporting bank lending data and other activities.

Barofsky didn't see it that way. "With all due respect to Mr. Allison, the things that he's described and that they're doing falls far, far short of meeting this basic level of transparency," he said.

Treasury spokeswoman Meg Reilly said that when Treasury has declined to implement a SigTARP recommendation, it has nonetheless tried different ways to meet the recommendation's goal.

Barofsky's office has kicked into action. He has a staff of 86, on its way to 160. He has drawn investigators from the FBI, Secret Service, homeland security, energy and housing agencies. A team recently went to Texas for an audit on mortgage servicers.

More than half of its investigations come from tips from a telephone hotline, which has had 7,000 inquiries, or over the Internet. The office's Web site has gotten 26 million hits. The rest come from a combination of referrals from other agencies and follow-ups on reports in the news media and on blogs.

In the meantime, he said his office is investigating fraud and scams. Earlier this year, it worked with the Federal Trade Commission to shut down an Internet company purporting to be the government Web site for a program to help modify home mortgages.

Barofsky said he expects his office to produce a "lot more activity" going after home mortgage modification fraud.

"We've got a pretty good number of investigations underway," he said. ![]()