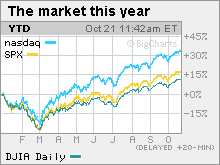

Stocks fall from one-year highs

Banking, retail and technology lead a late-session selloff as investors back off after pushing the Dow, Nasdaq and S&P 500 to 2009 highs.

NEW YORK (CNNMoney.com) -- Stocks tumbled Wednesday afternoon, after influential analyst Richard X. Bove downgraded his rating on Wells Fargo, sparking a steep selloff in the banking sector.

The Dow Jones industrial average (INDU) lost 92 points, or 0.9%. The S&P 500 (SPX) index lost 10 points, or 0.9%. The Nasdaq composite (COMP) lost 13, or 0.6%.

Stocks had rallied through the early afternoon as investors welcomed better-than-expected results from Wells Fargo, U.S. Bancorp and Morgan Stanley.

But Bove's note knocked the wind out of the banking sector in the late afternoon, and that sent the rest of the market lower.

Bove of Rochdale Securities cut Wells Fargo to "sell" from "neutral" following the company's better-than-expected quarterly earnings. While acknowledging the earnings surprise, Bove said essentially that the meat of the report is a lot more mixed, and that losses due to bad loans seem to be accelerating.

"That was a blind side," said Joseph Saluzzi, co-head of equity trading at Themis Trading. "The downgrade in the middle of the day to a major bank caused the speculators to jump," he said.

Saluzzi said that the abrupt turnaround in direction is reflective of that fact that day-traders and other Wall Streeters with a short-term focus are driving the market right now,

Also rattling banks during the day: talk that the Obama administration will require executives at firms that took the most bailout money take big pay cuts. Kenneth Feinberg, the administration's "pay czar," will call for the seven biggest bailout recipients to cut total pay packages for their 25 highest paid employees by an average of 50%, a senior official confirmed to CNN Wednesday.

Investors are deep in the thick of the quarterly reporting period, with 135 of the S&P 500 companies reporting results this week. After the close Wednesday, eBay (EBAY, Fortune 500) reported weaker quarterly earnings that topped estimates, but the online marketplace also issued a fourth-quarter earnings forecast at the low end of analysts' expectations. Shares fell 5% in extended-hours trading.

Results: Stocks slipped Tuesday, as disappointing results from DuPont (DD, Fortune 500) and Coca-Cola (KO, Fortune 500) and a weaker-than-expected reading on the housing market caused investors to step back. But the rally found some new fuel through most of Wednesday until the 11th hour selloff.

So far, 122 companies, or nearly one-fourth of the S&P 500, have reported results. Profits are currently on track to have fallen 20.9% versus a year earlier, according to the latest from Thomson Reuters. Revenue is expected to have dropped 10.4% from a year ago.

The Dow 30's results are expected to be weaker, Thomson said, with profits due to slide just short of 30% versus a year ago.

Banks: Wells Fargo, U.S. Bancorp and Morgan Stanley were among the companies reporting better-than-expected quarterly results Wednesday, while Boeing missed forecasts.

Wells Fargo (WFC, Fortune 500) reported a profit of $3.2 billion in its latest quarter as strength in its mortgage-lending business and other units tempered the impact of losing billions in bad loans. The bank reported higher quarterly earnings that soundly topped estimates. Shares were up moderately in the morning, but they fell 1% by the end of the day.

U.S. Bancorp (USB, Fortune 500) reported weaker quarterly earnings that topped estimates thanks to strong mortgage banking revenue, up 350% from a year ago. Shares rose 6.7%.

Morgan Stanley (MS, Fortune 500) reported its first quarterly profit in a year Wednesday thanks to strong fixed-income sales and trading revenue. The bank reported earnings and revenue that fell from a year ago but topped estimates. Shares gained 7%.

Other results: Dow component Boeing (BA, Fortune 500) reported an earnings-per-share loss versus a year-ago profit due to expenses connected to its long-delayed 787 Dreamliner program. The aerospace developer also reported higher revenue. Both revenue and earnings results fell short of analysts' estimates.

Boeing also cut its 2009 earnings outlook. Shares fell 1%.

Other big Dow losers included Caterpillar (CAT, Fortune 500), IBM (IBM, Fortune 500), Merck (MRK, Fortune 500), Home Depot (HD, Fortune 500), Wal-Mart Stores (WMT, Fortune 500), JPMorgan Chase (JPM, Fortune 500), McDonald's (MCD, Fortune 500) and Pfizer (PFE, Fortune 500).

After the close Tuesday, Yahoo (YHOO, Fortune 500) reported higher quarterly earnings that beat forecasts on weaker revenue that also beat forecasts. Shares climbed 2% Wednesday.

In other company news, Sun Microsystems (JAVA, Fortune 500) said late Tuesday that it was cutting 3,000 jobs related to its purchase by Oracle (ORCL, Fortune 500). Its stock fell 3%.

The VIX: The CBOE Volatility index, Wall Street's so-called fear gauge, hit a 14-month low of 20.10 Wednesday morning. While that would seem to be a positive, since it implies investor anxiety is waning, it also suggests that investors could be getting too complacent and that a bigger stock retreat could be in store. The VIX bounced back after the stock selloff, ending at 22.22.

Labor market: All 50 states and the District of Columbia reported big jumps in unemployment rates in September versus a year ago, according to state-by-state data released Wednesday. Fifteen states reported jobless rates above 10% in September, with Michigan's unemployment topping the list at 15.3%.

Economy: The economy has shown signs of stabilizing or even improving in recent weeks, according to the Fed's "beige book" of economic conditions, released in the afternoon.

World markets: Global markets were mixed. In Europe, London's FTSE 100 rose 0.3%, France's CAC 40 was barely changed and Germany's DAX added 0.4%. Asian markets ended lower.

Bonds: Treasury prices rallied, lowering the yield on the 10-year note to 3.41% from 3.34% late Tuesday. Treasury prices and yields move in opposite directions.

Currency and commodities: The euro jumped to a 14-month high against the dollar, extending its recent run against the U.S. currency. The dollar inched higher versus the yen.

U.S. light crude oil for December delivery rose $2.25 to settle at $81.37 a barrel on the New York Mercantile Exchange, pushing toward a fresh one-year high. Prices rose after the latest weekly supply data from the government showed a smaller-than-expected rise in crude supplies.

COMEX gold for December delivery rose $5.90 to settle at $1,064.50 an ounce. Gold has surpassed records repeatedly this month due to the weak dollar and longer-term worries about inflation.

Market breadth was negative. On the New York Stock Exchange, losers beat winners three to two on volume of 1.4 billion shares. On the Nasdaq, decliners topped advancers by more than two to one on volume of 2.60 billion shares. ![]()