Consumer protection agency moves ahead

A proposed new consumer regulator for mortgages and credit cards moves forward in Congress. A key House panel votes along party lines to approve bill.

|

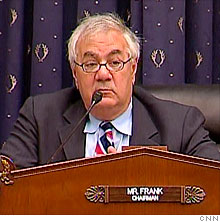

| Rep. Barney Frank's House Financial Services passes the consumer agency. |

WASHINGTON (CNNMoney.com) -- A key House committee on Thursday approved the most high-profile part of the White House plan to prevent future financial collapse: The creation of a new agency to regulate consumer financial products.

The House Financial Services committee voted along party lines 39-29 to empower a Consumer Financial Protection Agency to watch out for consumers.

The vote marks one of the most significant steps yet in congressional efforts to reform regulation in response to the financial crisis.

After more than a week of debate and changes, lawmakers and consumer advocates claimed victory. Most of the financial industry lobbied to kill it, calling it an unprecedented step toward government intrusion on business.

"This bill has now passed a major hurdle and this step sends an important signal to the American people that we will not stand by and allow big financial firms and their lobbyists to mobilize against change," President Obama said in a statement.

However, the bill was watered down in some key areas from the original Obama administration proposal.

The consumer agency would be a brand new regulator whose chief concern is looking out for consumers. It would write rules aimed at ensuring that financial products like mortgages and credit cards are fair, more transparent and more easily understood.

The biggest change was to allow 98% of the banking industry -- some 8,000 community banks and credit unions -- to keep their current regulators when it comes to enforcing new consumer rules.

"That was a compromise I thought was necessary to get the bill out," said House Financial Services Chairman Barney Frank, D-Mass., at a press conference Thursday. "That's the major area where many of us would like to change that."

Another change: lawmakers allowed some special exceptions to allow federal regulators to overrule stronger state consumer protection laws on a case-by-case basis. The original White House proposal called for empowering states to create tougher laws for the banking industry, even if state laws clashed with weaker federal laws -- a reversal from current practices.

Earlier this month, the panel had already agreed that the panel would not have the ability to mandate simple standardized financial products.

Also, several types of businesses, including some originally envisioned as coming under the agency's authority, would not be subject to its rules. Among these are retailers, auto dealers, lawyers, title insurers and accountants.

Even auto dealers' financing products, which help consumers buy cars, have been exempted. Frank said they plan to fight to reinstate that when the bill goes to the floor.

One amendment to the bill that failed to win enough support would have allowed the agency to do a "financial autopsy" on the problem of bankruptcies and foreclosures, to discern whether financial products were the cause. The bill would then have allowed the agency to ban products.

The next step for the proposed Consumer Financial Protection Agency is a vote before the full House. Also, the Senate has yet to release its proposed bill on the issue, although Banking Committee Chairman Sen. Chris Dodd, D-Conn., has praised the idea in the past. ![]()