Stocks struggle after record

Wall Street is choppy one day after the blue-chip indicator closes at a 14-month high. Investors consider GM shakeup, record gold prices, employment data.

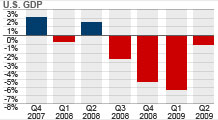

NEW YORK (CNNMoney.com) -- Stocks struggled Wednesday as investors sought more evidence that a recovery is taking hold, one day after the Dow industrials closed at its highest point in 14 months.

Mixed readings on the labor market, GM's management shakeup and record gold prices above $1,210 an ounce all played a role in the day's trading.

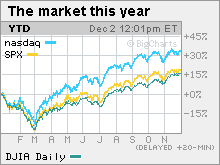

The Dow Jones industrial average (INDU) lost 19 points, or 0.2%. The blue-chip average ended the previous session at the highest point since Oct. 2, 2008. The S&P 500 (SPX) index ended little changed. The Nasdaq composite (COMP) rose 9 points, or 0.4%.

Stocks struggled as investors sorted through the day's news and geared up for the big monthly jobs report due Friday. Ahead of that, investors will keep an eye on Thursday's weekly jobless claims report from the Labor Department.

JPMorgan Chase (JPM, Fortune 500), American Express (AXP, Fortune 500), Chevron (CVX, Fortune 500) and Exxon Mobil (XOM, Fortune 500) were among the Dow's biggest losers.

The Fed released its periodic "Beige Book" reading on economic conditions in the nation's 12 districts. The central bank said economic conditions have improved modestly since its last report in the third week of October. However, labor market conditions remained weak and commercial real estate markets deteriorated.

"The report basically confirms that things are better than they have been, but that we are by no means off to the races," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc.

Shapiro said that, in the near term, it's fair to say that the data have largely supported the stock gains. But next year is more concerning.

"The issue is whether we're going to see enough profit growth and economic growth next year to justify continued equity gains," he said. "I'm concerned that by the second half of the year, we're going to run into more problems."

Stocks rallied Tuesday as worries about Dubai's debt problems eased, pushing the Dow to a 14-month high. The Nasdaq and S&P 500 both closed short of 14-month highs.

General Motors: GM's CEO Fritz Henderson resigned late Tuesday and will be replaced by chairman Ed Whitacre on a temporary basis, until a successor can be found.

Henderson was a 25-year GM veteran who took over as CEO in March after Rick Wagoner was forced out by the Obama administration as part of GM's government-supervised restructuring.

Labor market: The first in a three-day blitz of readings on the job market got underway Wednesday with mixed results.

Payroll services firm ADP said employers in the private sector cut 169,000 jobs from their payrolls in November versus forecasts for cuts of 150,000 jobs. Employers cut 196,000 jobs in October.

The report is seen as something of a precursor to the broader monthly labor market report due out Friday in which employers are expected to have cut 120,000 non-farm payroll jobs in November after cutting 190,000 in October.

Employers announced 50,349 planned job cuts in November, according to another report from outplacement firm Challenger, Gray & Christmas, down 9.6% from October and the lowest number in almost two years. But the total number of cuts announced this year have already outpaced last year's total.

Gold touches $1,200: COMEX gold for February delivery rallied $12.80 to settle at $1,213 an ounce, a new closing high. Gold rose as high as $1,218.40 during the session.

The dollar and oil: The dollar gained versus the euro and the yen after hovering in mixed territory in the morning.

U.S. light crude oil for January delivery fell $1.77 to settle at $76.60 a barrel on the New York Mercantile Exchange.

World markets: Overseas markets inched higher, with London's FTSE 100, Germany's DAX and France's CAC 40 all ending with slim gains. Asian markets advanced too, with Japan's Nikkei ending 0.4% higher.

Bonds: Treasury prices slipped, raising the yield on the 10-year note to 3.31% from 3.28% late Tuesday. Treasury prices and yields move in opposite directions.

Market breadth was positive. On the New York Stock Exchange, winners beat losers three to two on volume of 1.03 billion shares. On the Nasdaq, advancers topped decliners by eight to five on volume of 2.08 billion shares. ![]()