Madoff's victims, one year later

A year after the Ponzi king was arrested, many of those he fleeced have yet to get their payback.

|

| One year after losing their life savings to Madoff, Allan and Ruth Goldstein live in a house they bought with their SIPC check. |

|

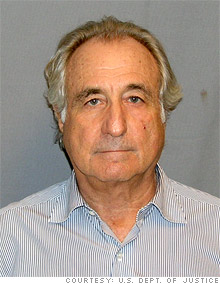

| Bernard Madoff, shown here in his jailhouse mug shot, ran the largest Ponzi scheme in history. |

NEW YORK (CNNMoney.com) -- One year since the arrest of Ponzi mastermind Bernard Madoff, most of his victims are still trying to recoup their losses.

"We've got nothing back," said Dana Foy, a 57-year-old computer programmer in New Mexico.

Foy, who wouldn't identify how much money he lost, saw his dream of a comfortable retirement with his wife wiped out by Madoff's scheme, which came crashing down when he was arrested on Dec. 11, 2008.

About $20 billion in investor funds were lost to Madoff's scam, according to the Web site of the court-appointed trustee Irving Picard, who is tasked with recovering and allocating as much of the money as possible. Some of the victims have been reimbursed, but many are still waiting.

Of the 16,000 claims that have been filed, about 70% have been processed, according to Picard. Of those 11,563 processed claims, 1,647 have been determined to be valid. Most of the claims, some 9,916, have been denied.

Most of the denied claims are "indirect" investors who did not have an account at Madoff's firm, according to Stephen Harbeck, chief executive of the Securities Investor Protection Corporation. Indirect investors include those in feeder funds, which are other funds that place their money with Madoff. Claimants have to try and get reimbursement from those fund managers, not through the trustee.

The SIPC has allocated $561.3 million to the 1,647 approved claims. Some of those claims have been paid out and some have not. But that still falls short of the $4.69 billion the trustee has earmarked for victim compensation - much of which would come from the sale of Madoff's assets.

The trustee has not yet sent out money from confiscated assets, which it is still in the process of recovering.

"We don't understand why it's taken so long," said Ilene Kent, coordinator with Investor Action Group, which was organized for Madoff victims like herself.

In an e-mail to CNNMoney.com, Harbeck identified the various factors that can affect "the reconstruction of a claim," including "the length of time a customer had an account, coupled with multiple withdrawals in addition to deposits and the completeness of the paperwork submitted by the customer."

The SIPC covers up to $500,000 per account for victims who've lost money. That includes Korean War veteran Allan Goldstein, 77, who said he had invested $2 million with Madoff's firm.

His final statement from Madoff said his investments had grown to $4.7 million. Goldstein had also drawn down about $300,000 annually to live on for a number of years.

Goldstein said the trustee subtracted the withdrawals from his $2 million investment, resulting in the $320,000 he received from SIPC. He and his wife used that money to buy a house in Great Barrington, Mass. Because of his withdrawals, Goldstein is not expecting to receive money from Madoff's confiscated assets.

Ponzi schemers operate by masquerading as legitimate money managers. Madoff didn't invest his clients' money -- he stole it. He kept the scam going for years by allowing some of his clients to withdraw money, while fraudulently portraying those withdrawals as legitimate returns.

Goldstein said that he and his wife currently live on Social Security and assistance from their children. That's a stark contrast from the affluent retirement that he'd planned.

"The whole thing is a nightmare," he said. "We do the best we can, and we're surviving. We're very happy, at least, to be living in our own home."

Any losses beyond SIPC are set to be recouped through the recovery of stolen assets, such as Madoff's yacht and his multi-million dollar properties in Manhattan, Montauk, N.Y., Palm Beach, Fla. and Cap d'Antibes on the French coast.

Maureen Ebel, 61, of West Chester, Pa., said she invested $5.3 million in Madoff's firm through two separate accounts, and the latest statement from the firm said her investments had grown to $7.3 million. She recovered $1 million from SIPC -- $500,000 for each of her two accounts -- but she's still missing millions.

"I don't think I'll ever see any of it, quite frankly," said Ebel. "We don't even know where it is."

So far, investigators say they have confiscated about $1.5 billion worth of assets from Madoff's estate, which falls far short of the approximately $20 billion in investor funds that were lost to his scheme.

The recovery process continues. Picard has filed 14 lawsuits against Madoff's friends and family.

Investigators have no idea how long it will take to track down the stolen money and have not set a deadline for discontinuing the recovery, according to the trustee's office.

Meanwhile, Madoff languishes in prison. He pleaded guilty in March to 11 counts related to running his Ponzi scheme and was sentenced to 150 years. Madoff, 71, is incarcerated at the Federal Correctional Institution Butner in North Carolina and faces an official release date of Nov. 14, 2139.

But this provides little comfort to some of this victims.

"He's away, he can't hurt anyone else, and that's a good thing," said Mike De Vita, a computer programmer from Philadelphia who lost 40 years worth of retirement savings to Madoff's scam. "But other than that, what happens to Bernard Madoff doesn't really matter."

Ebel, who ditched her plans for a comfortable retirement and reentered the workforce as an office manager, resents Madoff for wiping out the savings that her late husband had left her.

"[Madoff] has ruined so many lives and caused so much pain to so many people that he will never get what he deserves until he dies," she said. "May God have mercy on him." ![]()