Search News

NEW YORK (CNN) -- Tired of your old credit card rate? Skyrocketing fees and shrinking credit limits? In the first of our series on Financial Resolutions -- here's how you can find the best terms.

If you're fed up with your credit card, you have every right to be.

|

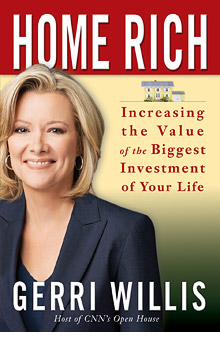

| For more information on managing your largest investment, check out Gerri Willis' 'Home Rich,' now in bookstores. |

| MMA | 0.69% |

| $10K MMA | 0.42% |

| 6 month CD | 0.94% |

| 1 yr CD | 1.49% |

| 5 yr CD | 1.93% |

Credit card issuers, on average, have raised rates up to 15% since January, according to billshrink.com. The average American is likely have paid about $110 more in credit card interest fees since the beginning of the year, or $10 billion for Americans as a whole. The worst offenders here: Capital One (COF, Fortune 500), Citi (C, Fortune 500) and Discover (DFS, Fortune 500) according to Billshrink.com. Their cardholders were socked with an average 32% rate increase since January.

Fortunately, the end of arbitrary rate hikes is coming very soon. The House voted to enforce tougher credit card rules with the CARD Act by February 22, 2010, although not in time for the holidays when credit-card purchases skyrocket.

So, the big question is how can you find a card that best fits your needs and your wallet?

First -- try a different bank. Local community banks typically have rates that are 1-2 percentage points lower that big bank cards.

If you do decide to switch to a new card, here are some things you should ask for before signing up. You should be getting an interest rate below 10%, if you have good credit. Make sure that fees are capped and that you have a grace period of 25 days to get your payments to the right place.

We consulted with Curtis Arnold of Cardratings.com for his best picks this year. Here's the list:

-- CNN's Jen Haley contributed to this article.

Talkback: Are you looking to switch credit cards in 2010? ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |