Search News

NEW YORK (Fortune) -- Kraft's biggest shareholder isn't sweet on the food giant's hostile bid for candy maker Cadbury.

Billionaire investor Warren Buffett said Tuesday he voted against Kraft's (KFT, Fortune 500) proposal to authorize the issuance of 370 million new shares in its $16 billion cash-and-stock offer for Cadbury. Buffett said heavy issuance of Kraft's shares, which he views as undervalued, would hurt Kraft's shareholders.

|

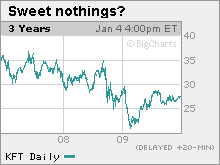

| Kraft shares have been slipping since Warren Buffett started buying. |

Buffett is CEO of Berkshire Hathaway (BRKA, Fortune 500), which owns 138 million Kraft shares. That gives it a 9.4% stake in the Northfield, Ill., maker of Oreo cookies and American cheese slices, and makes Berkshire Kraft's largest shareholder.

The news came on the same day that Kraft announced it was selling its North American frozen pizza business to Swiss food giant Nestle for $3.7 billion. Kraft said it would use the proceeds from that sale, expected to be around $2.2 billion, to increase the cash portion of its offer for Cadbury.

Cadbury rejected the new bid, calling it "derisory." Kraft shares rose 3% in early trading Tuesday.

Kraft has been asking shareholders to approve a proposal that would let Kraft issue as many as 370 million common shares in the Cadbury deal. Kraft began mailing voting materials to shareholders last month for a vote scheduled for Feb. 1

The company needs shareholder approval for the move to satisfy rules about increases in outstanding shares set by the New York Stock Exchange, where Kraft is listed.

Buffett's opposition could complicate Kraft CEO Irene Rosenfeld's efforts to expand her company's global reach. Kraft shares have traded at a discount to food industry peers amid questions about the company's growth prospects.

Kraft proposed in September to buy Cadbury in a transaction it said would create a "global powerhouse in snacks, confectionery and quick meals." London-based Cadbury (CBY) quickly rejected the unsolicited proposal, saying it "fundamentally undervalues" the company.

Taking that analysis a step further, Buffett said Tuesday he believes the Kraft proposal fundamentally hurts Kraft, because it relies on the issuance of massive amounts of stock at what he thinks are cut-rate prices.

"Kraft stock, at its current price of $27, is a very expensive 'currency' to be used in an acquisition," Buffett said in a statement Tuesday morning. "In 2007, in fact, Kraft spent $3.6 billion to repurchase shares at about $33 per share, presumably because the directors and management thought the shares to be worth more."

Buffett himself seems to have been in that camp. Starting in 2007, Berkshire paid an average of around $33 a share for the bulk of its Kraft holdings. At current prices Berkshire is under water on that investment, its third-largest in a single public company, by around $900 million.

The price of Kraft shares isn't Buffett's only quarrel with the Kraft plan to buy Cadbury. He suggested that a "yes" vote on the share issuance proposal could give management room to raise its bid for Cadbury, further damaging shareholder interests.

"The share-issuance proposal, if enacted, will give Kraft a blank check allowing it to change its offer to Cadbury -- in any way it wishes -- from the transaction so carefully described to shareholders in the proxy statement," Buffett wrote. "We worry very much, indeed, that there will be a change."

The Kraft bid is worth about 740 pence per Cadbury share. But Cadbury shares have traded near 800 pence in London, as investors wager that Kraft will be willing to raise its offer.

Kraft said Tuesday that it expected to offer about 60 pence more in cash to Cadbury shareholders following the completion of the frozen pizza sale to Nestle. But the total value of the Cadbury offer is not changing. Kraft also said it was extending its offer, which originally was set to expire on Tuesday, to Feb. 2.

Kraft, apparently referring to Buffett, noted in its statement Tuesday that certain shareholders "have expressed a desire for Kraft Foods to be more sparing in its use of undervalued Kraft Foods shares as currency for the offer."

Hershey (HSY, Fortune 500), the U.S. chocolate company that has been struggling with growth issues of its own, has reportedly been studying a rival bid for Cadbury, but so far has remained on the sidelines.

Nestle (NSRGY), which had also been said to be mulling a bid for Cadbury, said Tuesday that it "does not intend to make, or participate in, a formal offer for Cadbury."

Cadbury maintained in a presentation last month that the Kraft offer is low, given Cadbury's strong growth, rising profit margins and market share gains.

Kraft, in turn, questioned the validity of Cadbury's projections, while promising not to overspend.

"Kraft Foods will continue to maintain a disciplined approach with respect to the acquisition of Cadbury in line with the criteria outlined in our offer documentation," Rosenfeld said in a statement last month. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |