Search News

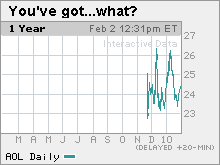

NEW YORK (Fortune) -- AOL is back. Should you buy it?

The New York-based Internet company is due to report quarterly earnings Wednesday morning for the first time since it regained its independence from Time Warner (TWX, Fortune 500).

|

| AOL stock is back, but analysts aren't sure why you'd want it right now. |

It will also be AOL's first report as a standalone firm since October 2000, when America Online was preparing to complete its merger with Time Warner -- which publishes Fortune and CNNMoney.com. Many experts now think the AOL Time Warner deal is perhaps the most disastrous corporate marriage of all time.

Late last year, Time Warner spun AOL off to shareholders. What Time Warner shareholders got is a bit of a mess. But AOL's report will give CEO Tim Armstrong his biggest stage yet to extol the virtues of the latest AOL (AOL) relaunch.

Yet as momentous as the occasion is, it will be a while yet before any AOL bandwagon leaves the station. Wall Street analysts agree that Armstrong, a 38-year-old former Google (GOOG, Fortune 500) ad chief who joined AOL last spring, has his work cut out for him.

Imran Khan of J.P. Morgan, wrote in a note to clients last month that investors should "remain on the sidelines as AOL plays catch up after a decade without innovation."

With that in mind, here are five key issues investors will be watching for in AOL's report and conference call with analysts.

Profit: Analysts expect AOL to make 67 cents a share for the fourth quarter on revenue of $766 million, down 21% from a year ago. The company should make around $70 million in the fourth quarter -- just a shadow of the $350 million America Online made in its last quarter as a public company in 2000 (though some of those gains, it turns out, were cooked up in an accounting scandal).

Display ads: Armstrong said last month his top priorities for this year include making sure that AOL properties "really become the leaders in display advertising." So far, there is little sign of this. Analysts at Citi expect display ad revenue to drop 13% from a year ago to $164 million. And Khan estimates that display revenue at AOL is 40% less per unique user than such sales at rival Yahoo (YHOO, Fortune 500).

Search revenue: Investors are looking forward to year-end, when AOL's search partnership with Google expires. A new deal will give AOL a chance to improve the user experience, Khan writes. He notes that a recent search of the same terms on Google returned more than three times as many results than on AOL. In the meantime, AOL continues to lose market share, with Benchmark analysts citing an 18% decline in fourth-quarter search volume.

Subscribers: AOL still gets the vast majority of its profits from its ancient dial-up Internet access business, even as the user base dwindles toward 5 million. It was four times that a decade ago. Benchmark's Edward Moran projects subscription revenue dropped 29% in the fourth quarter to $305 million.

Content: AOL is planning to spend $100 million to create new content through data analysis and freelancers reporting to the company's editorial staff. Khan calls the strategy "compelling" because of its low fixed costs, but adds that "such a model is unproven at this point and we see execution risks associated with it."

Of course, execution risk is nothing new at AOL. As its founder Steve Case once said, adapting Thomas Edison's quote to the failure of the AOL-Time Warner merger, "Vision without execution is hallucination." AOL fans have had enough of that. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |