Search News

NEW YORK (CNNMoney.com) -- JPMorgan Chase Chairman and CEO Jamie Dimon will take home a nearly $16 million bonus in restricted stock and options for leading the bank to a big profit last year.

In a company filing with the Securities and Exchange Commission Friday, the New York City-based bank said Dimon would collect nearly 200,000 shares of restricted stock and more than a half million in options.

|

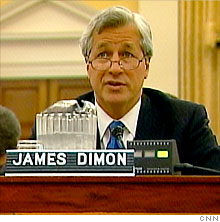

| Dimon, testifying before Congress last month on the financial crisis, will bring home $17 million for all of 2009. |

According to a source familiar with the matter, Dimon did not receive a cash bonus. Wall Street firms in general have migrated from paying their employees large cash bonuses to stock and options in response to public outcry over bonuses and in an effort to tie employee compensation to company performance.

Based on Thursday's closing price of $38.35 per share, Dimon's restricted stock payment would be worth about $7.5 million.

His significantly larger options payment however, would only translate into profits if JPMorgan Chase's (JPM, Fortune 500) stock price climbs above $43.20 per share.

Both payments are to be deferred over several years and are subject to so-called "clawback" provisions, which can reclaim pay from workers whose actions may damage the firm's long-term financial health.

Including the $1 million base salary Dimon received for the year, his total pay package for 2009 is nearly $17 million.

Dimon received no bonus in 2008 and a $28 million bonus in 2007

In a year when the banking industry struggled due to massive mortgage and consumer loan losses, JPMorgan Chase fared relatively well compared to many of its peers.

Last month, the bank revealed it earned $11.73 billion in 2009, more than twice what it earned just a year earlier. That translated into a better year for JPMorgan workers, including the 25,000 employees working on Wall Street.

The company said it spent $9.33 billion to pay workers in its investment banking division, an increase of $1.6 billion from a year ago. That figure includes salaries as well as money set aside for bonuses and works out to an average annual compensation per employee of nearly $380,000.

All eyes are now focused on Goldman Sachs (GS, Fortune 500), which has yet to disclose its year-end bonuses for its top executives.

While members of Goldman's management committee declined to take cash bonuses for 2009, there is still speculation that its executives could collect a windfall in stock and options. The Times of London reported earlier this month that company CEO Lloyd Blankfein could receive a bonus payment of close to $100 million. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |