Search News

NEW YORK (CNNMoney.com) -- Stocks ended a choppy session lower Monday as investors weighed earnings news, President Obama's health care proposal and Schlumberger's $11 billion buyout deal for oil services rival Smith International.

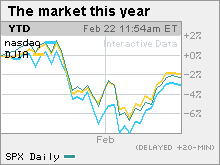

The Dow Jones industrial average (INDU) lost 19 points or 0.2%. Last week, the Dow surged 300 points for its biggest one-week gain since November.

The S&P 500 index (SPX) eased 1 point, or 0.1%. The Nasdaq composite (COMP) slipped 2 points, or 0.1%.

"The markets are fairly quiet after a strong week," said Alan Gayle, senior investment strategist at RidgeWorth Investments. "But after a 65% run [on the S&P 500] off the lows and some concerns about the economy in the near term, I'm expecting more choppiness in the weeks ahead."

Gayle said investors were eying the deal and earnings news, the direction of the dollar and commodity prices. Investors may have also taken comfort from signs that regulatory changes being proposed in Washington will be milder than feared, he said, including the provisions in President Obama's health care plan, announced Monday.

Stocks ended higher last week as investors digested the Federal Reserve's decision to lift the emergency bank lending rate. Stocks also posted gains for the second week in a row after four weeks of declines.

But after that advance, stocks are bound to be volatile this week amid ongoing concerns about the outlook for the U.S. economy. Reports are due on housing, jobs and GDP growth. Federal Reserve Chairman Ben Bernanke testifies before Congress Wednesday and Thursday. Lawmakers meet in Washington later this week to discuss the Toyota recall, bank health and fiscal stimulus.

Corporate news: Schlumberger (SLB) said it was buying fellow oil driller Smith International (SII, Fortune 500) in an all-stock deal worth $11 billion. The two companies' boards of directors have already approved the deal and shareholders are expected to follow suit. Schlumberger shares fell 3.7% and Smith shares gained 8.8%.

In other company news, Lowe's (LOW, Fortune 500) reported higher-than-expected quarterly earnings and revenue and said sales would keep rising in the current year. However, shares of the home improvement retailer were little changed.

Shares of Dow component Bank of America (BAC, Fortune 500) rose just over 2% after a judge approved the proposed $150 million settlement between the financial firm and the Securities and Exchange Commission.

Credit cards: New credit card rules aimed at protecting consumers went into effect Monday. However, the regulations could result in consumers facing new charges and additional fees as the industry looks to offset the lost revenue.

Health care: President Obama presented his outline for health care reform Monday, ahead of the bipartisan health care summit later this week. The 10-year, nearly $1 trillion plan would purportedly cover more than 31 million Americans currently not insured without adding to the budget deficit.

The plan also allows the government to shoot down or roll back insurance premium hikes.

Economy: A survey from the National Association for Business Economics showed that most leading economists think the recovery will remain on track.

World Markets: In overseas trading, most European markets ended lower and Asian markets ended higher.

The dollar and commodities: The dollar fell versus the euro and gained against the yen.

U.S. light crude oil for March delivery rose 35 cents to settle at $80.16 a barrel on the New York Mercantile Exchange.

COMEX gold for April delivery fell $8.70 to settle at $1,112.60 per ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.79% from 3.77% late Friday. Treasury prices and yields move in opposite directions.

Market breadth was mixed. On the New York Stock Exchange, losers beat winners by a narrow margin on volume of 950 million shares. On the Nasdaq, advancers topped decliners seven to six on volume of 1.95 billion shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |