Search News

NEW YORK (CNNMoney.com) -- Wall Street erased gains by the close Wednesday, as relief about the day's economic news gave way to concerns about the job and manufacturing reports due out over the next two days.

Also in play: An announcement from Greece about the steps it will take to cut its deficit.

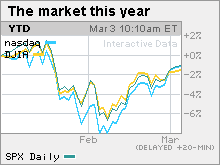

The Dow Jones industrial average (INDU) lost almost 10 points or 0.1%. The S&P 500 index (SPX) and the Nasdaq composite (COMP) ended little changed.

Stocks had posted slim gains through the early afternoon following reports showing some stability in the job market and a pick up in the services sector. But the gains petered out in the afternoon as investors hesitated ahead of a series of telling economic reports due Thursday and Friday.

On Thursday, the government releases monthly factory order and weekly jobless claims information, while the nation's retailers reveal February sales.

Stocks have drifted higher over the past three sessions, pushing the S&P 500 and the Nasdaq into positive territory for 2010. The Dow briefly moved into positive territory during Wednesday's session, before retreating.

After a strong rally in 2009, stocks have been volatile this year as investors look for evidence that an economic recovery is taking hold, above and beyond the considerable government stimulus that has been put into play.

"As we move forward, there's a lot of concern about whether the economy can stand on its own two feet without all the stimulus," said Tyler Vernon, chief investment officer at Biltmore Capital.

He said that so far this year, when the market moves up for a few days, investors question whether the move is sustainable and end up pulling back.

"Today we had a rally going, but then with unemployment reports due Thursday and Friday, people decided they didn't want to hold stocks ahead of that," he said.

Market participants have also been reluctant to move much in the aftermath of a big rally last year. Between the lows of last March and the highs of January 2010, the S&P 500 jumped 70%.

Jobs: A pair of economic reports showed that the pace of job cuts is slowing as the labor market slowly begins to stabilize.

Payroll services firm ADP said employers in the private sector cut 20,000 jobs from their payrolls in February, meeting the expectations of economists surveyed by Briefing.com. The drop was the smallest decline in two years. In January, employers cut a revised 60,000 jobs.

Outplacement firm Challenger, Gray & Christmas said that 42,090 job cuts were announced in February, down from 71,482 in January. It was the smallest number of announced job cuts since July 2006, when 37,178 cuts were announced.

Separately, the Senate voted late Tuesday to extend the deadline for unemployed Americans to apply for benefits, after previous attempts to do so failed. President Obama signed the measure shortly thereafter.

Over 200,000 people would have stopped receiving unemployment checks this week.

Beige Book: Investors had a mild reaction to the Fed's periodic "Beige Book" reading on the economy, released in the afternoon. The Beige Book showed that economic activity picked up somewhat in 9 of the Fed's 12 districts. Consumer spending also improved modestly.

Services sector grows: In other economic news, the Institute for Supply Management's services sector index rose to 53 in February from 50.5 in January, hitting the highest point since December 2007, at the start of the recession. Economists surveyed by Briefing.com thought it would rise to 51.

Greece: The debt-strapped nation announced a $6.5 billion plan Wednesday to help it cut its ballooning deficit. The plan includes $3.3 billion in new revenues such as taxes and another almost $3.3 billion in spending cuts, including pension freezes and cuts in civil servants' salaries.

Worries that Greece might default on its debt have pummeled the euro and unnerved world markets over the last two months, as investors have wondered if the problems are indicative of a bigger euro zone crisis.

The European Union said Wednesday that it will more closely regulate the economies of its 27 members so as to avoid a repeat of the Greece crisis. The new system will issue warnings if a country is heading for trouble, something that might have alerted officials to Greece's problems at an earlier date.

On the move: Hedge fund Elliott Associates made an unsolicited all-cash offer for Novell (NOVL) that values the business software maker at around $2 billion.

Elliott Associates offered to buy the remaining 91.5% of the company it doesn't already own for around $5.75 per share, or $1.83 billion. The price is a 21% premium over Novell's closing stock price from Tuesday.

Novell jumped 28% and was the Nasdaq's most-actively traded issue.

On the downside, biotech Medivation (MDVN) lost two-thirds of its value after the company said that its experimental Alzheimer drug Dimebon failed to produce desired results in a late-stage clinical study. Dow component Pfizer (PFE, Fortune 500), which co-develops the drug, lost 1.6%.

Among other Dow movers, Caterpillar (CAT, Fortune 500), Home Depot (HD, Fortune 500), General Electric (GE, Fortune 500), Coca-Cola (KO, Fortune 500) and Boeing (BA, Fortune 500) all gained.

Market breadth was positive. On the New York Stock Exchange, winners topped losers eight to seven on volume of 950 million shares. On the Nasdaq, advancers topped decliners seven to six on volume of 2.55 billion shares.

World Markets: In overseas trading, European markets rallied, with the London FTSE rising 0.9%, the French CAC 40 gaining 0.8% and the German DAX advancing 0.7%. Most Asian markets ended lower, although the Japanese Nikkei rose 0.3%.

The dollar and commodities: The dollar gained versus the euro and fell versus the yen.

U.S. light crude oil for April delivery rose $1.19 to settle at $80.87 a barrel on the New York Mercantile Exchange.

COMEX gold for May delivery gained $5.90 to settle at $1,143.30 per ounce.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 3.61% from 3.60% late Tuesday. Treasury prices and yields move in opposite directions. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |