Search News

NEW YORK (CNNMoney.com) -- Added incentives for banks to make Small Business Administration-backed loans will continue through the end of March, thanks to a fresh funding infusion authorized by Congress as part of Tuesday's bill extending unemployment benefits.

Since early last year, the SBA has waived its fees and offered banks guarantees of up to 90% on the small business loans the agency backs. Created as part of the Recovery Act, the deal sweeteners helped SBA-backed lending rebound from its near collapse in late 2008, in the wake of the financial crisis.

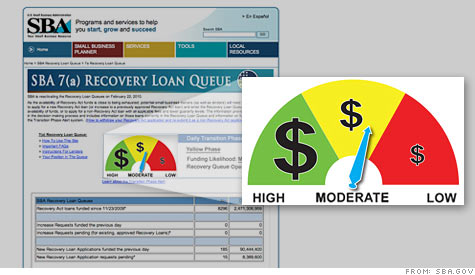

Congress initially authorized the incentives to continue through September of this year, but the measures proved so popular that their funding was quickly exhausted. The SBA has been relying since late November on temporary extensions to keep the incentives running.

The unemployment benefits extension bill -- passed by the Senate and signed by President Obama late Tuesday after Sen. Jim Bunning, R-Ky., dropped his objection -- allocates $60 million to fund the program's subsidies for another month.

That's a relief for those left in limbo. On Wednesday, the SBA had 520 loan applications totaling $206 million on hold in its Recovery Loan Queue, awaiting the additional funding from Congress before they could be approved.

"It's completely disruptive," said Lynn Ozer, who heads SBA lending for Susquehanna Bank in Lititz, Pa. "We have been sort of stalling right now with the loans that are in house. The ones that we knew we were going to do, we put a full-court-press on to get them funded, because we knew the money was going to run out."

When the Recovery Act loan incentives expire, the SBA will revert to its traditional loan guarantees, insuring up to 85% of smaller loans and 75% of larger ones. If the business owner defaults on the loan, the SBA pays the bank back for the guaranteed portion.

Ozer had two loans caught in the queue, from local businesses looking to build or renovate. On one, construction work has already begun, and the bank will find a way to finance its completion, Ozer said. But the other loan might not go through if Susquehanna can't get the 90% SBA guarantee.

"The economy has changed our comfort level, especially for startup and commercial real estate," she said. "There's some loans we've stretched to do, as we should. If we go back to a 75% guarantee -- in a lot of cases, we're still going to be able to do it, but there are some people that just won't get loans."

The SBA and President Obama have asked Congress for funding to continue the fee waivers and higher guarantees through September. But this week's measure extends the program only through the end of this month, potentially setting up another scramble for banks and borrowers as the next deadline nears.

The uncertainty frustrates Ozer, whose borrowers were stuck on hold for the past week.

"Some of these small businesses, the difference between getting working capital today or getting working capital in four weeks could shut them down," she said. "There's a lot of businesses that are that close to the edge." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |