Search News

NEW YORK (CNNMoney.com) -- Long-term U.S. debt prices rose Thursday after a government auction of $13 billion in 30-year bonds.

What prices are doing: After the auction, the 30-year bond rose 16/32 to 99-13/32 and its yield fell to 4.665%. Bond prices and yields move in opposite directions.

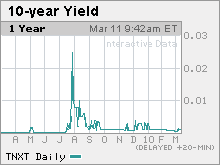

The benchmark 10-year note rose 1/32 to 99-7/32, with a yield of 3.723%.

Short-term notes fell after the auction. The 2-year note fell 3/32 to 99-28/32, with a yield of 0.956%. The 5-year note fell 4/32 to 99-28/32, with a yield of 2.41%.

What's moving the market: Thursday's 30-year-bond auction marked the last of the government's $74 billion offerings in notes and bonds this week. Demand was strong in the 3-year note sale Tuesday, the 10-year note auction Wednesday and continued to hold strong on Thursday.

Investors submitted bids totaling nearly $37.6 billion for the $13 billion worth of 30-year bonds.

The bid-to-cover ratio, a measure of demand, was 2.89. That was up from 2.36 at the previous auction in February.

Stocks dipped Thursday morning, partially offsetting Treasury losses, as investors weighed a mix of economic reports. The Labor Department reported a lower-than-expected drop in weekly jobless claims and an increase in continuing claims.

The Census Bureau reported that the trade gap narrowed in January to $37.3 billion -- significantly less than expected.

A report on foreclosure rates showed an increase on a year-over-year basis but the pace slowed.

What analysts are saying: Overall, Thursday looked to be "a pretty quiet day," said Wan-Chong Kung, a senior fund manager at First American Funds. The 30-year auction brought no surprises and economic reports released earlier in the morning weren't major drivers in the treasury market.

Meanwhile, investors are looking ahead to next week's Federal Open Market Committee meeting set for March 16. Will the Fed signal a change and begin to increase interest rates? That's the question on everyone's mind, Kung said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |