Search News

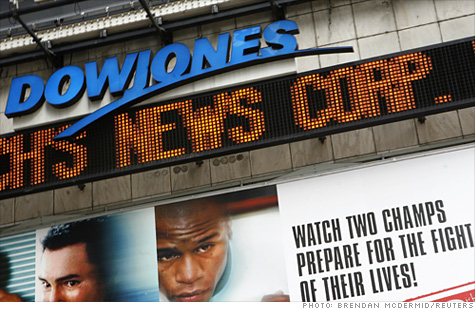

FORTUNE -- Editor's note: This week FORTUNE is publishing excerpts from its favorite business books of 2010. Today we revisit Sarah Ellison's blow-by-blow account of how media baron Rupert Murdoch wrested the Wall Street Journal away from the family that had controlled it for over 100 years.

Almost a month into the public's knowledge of Rupert Murdoch's bid for Dow Jones, Mike Elefante, the Hemenway & Barnes lawyer who sat on the Dow Jones board as a representative of the Bancroft family's various trusts, asked Peter McPherson, chairman of the board, if he could call a board meeting. "Any reason in particular?" McPherson queried, helpless before this diffuse family who controlled his fate. "I'd rather just cover it at the meeting," Elefante replied.

When the board convened via conference call at 5:00 p.m. on May 31, 2007, Elefante dutifully informed the directors why he had called them all to attention. The family had prepared a statement, he said.

He read it to the assembled directors:

As we have been since 1902, the Bancroft Family remains resolute in its commitment to preserve and protect the editorial independence and integrity of The Wall Street Journal, as well as the leadership, strength and vitality of The Journal and all of the other publications and services of Dow Jones.

Since first receiving the News Corporation proposal, the Family has carefully considered and discussed among ourselves and with our advisors how best to achieve that overarching objective, while serving the best interests of the Company's various constituencies.

After a detailed review of the business of Dow Jones and the evolving competitive environment in which it operates, the Family has reached consensus that the mission of Dow Jones may be better accomplished in combination or collaboration with another organization, which may include News Corporation. Accordingly, the Family has advised the Company's Board that it intends to meet with News Corporation to determine whether, in the context of the current or any modified News Corporation proposal, it will be possible to ensure the level of commitment to editorial independence, integrity and journalistic freedom that is the hallmark of Dow Jones.

The Family also indicated its receptivity to other options that might achieve the same overarching objective.

The board members and advisers on the call were stunned. The wording of the release, pored over by Bancroft advisers and a lone family member, Michael Hill, the youngest of the Hill brothers, may have seemed benign, but to those who understood the language of Wall Street, it hung a large For Sale sign on Dow Jones & Company. After 105 years, the family was throwing in the towel.

Richard Beattie, the lawyer for Dow Jones's independent directors, read one line of the family statement -- "the Family has reached consensus that the mission of Dow Jones may be better accomplished in combination or collaboration with another organization, which may include News Corporation" -- repeatedly out loud for the benefit of the Bancrofts on the call. Didn't they see what they were doing? he wondered.

The family was setting in motion something they didn't understand. They took the wording of their statement at face value, even the throwaway lines at the end of the release that stated that a deal might not happen. They thought they would see who was interested in buying Dow Jones and then make a decision about whether or not to sell the company.

That wasn't the way it worked. Beattie knew that the Bancrofts had done something that required the board to make independent decisions about the future of Dow Jones. No longer could the other directors channel the needs of their majority shareholder. The board was going to need to take action. It couldn't allow the family to float this statement without starting a formal "process" of its own to sell the company.

Mike Elefante did most of the talking for the other three family directors. Leslie Hill, Lisa Steele, and Chris Bancroft said little. McPherson suggested that the four family directors hang up to allow the rest of the board to talk about the family's statement. Elefante quickly offered that the family would be happy to stay on and join the discussion if the rest of the directors agreed. McPherson conferred with Beattie, who said there was no way the board could reasonably discuss the family's position as the controlling shareholder in the company with the family directors participating. McPherson told Elefante that the family had to get off the call. The division between the Bancrofts and the board was deepening.

So, too, were the divisions between board members. Harvey Golub, the Campbell Soup chairman and Peter Kann loyalist who said privately that he hoped the sale wouldn't go through, suggested that the directors might not need to put out their own release saying they would "explore strategic alternatives," which was code on Wall Street for "For Sale." The family's statement could speak for itself and the board could remain silent, he told the group.

Lewis Campbell, the chairman of the board's governance committee, wasn't going to take the risk. If the family was open to selling the company, he thought, the board's obligation was to sell it to the highest bidder. To stand in the way of doing so -- and in the way of common shareholders getting their money -- was inviting lawsuits. "We have a knife to our throats," he said, his southern twang hardening. "We have no choice." The other directors agreed with him, and they quickly crafted their own statement, which they planned to release at the close of the board meeting.

When the family directors rejoined the call, McPherson told them that given the family's stance, the board would release a statement saying that it had decided "to consider strategic alternatives available to the company, including the News Corporation proposal."

Chris Bancroft listened to McPherson, bewildered. "Wait a minute," he said. "My family didn't understand that this meant we were for sale." Beattie, now slightly amused and exasperated, repeated the section of the family's statement that seemed to indicate, unmistakably, that that was exactly what the family understood: "'The Family has reached consensus that the mission of Dow Jones may be better accomplished in combination or collaboration with another organization, which may include News Corporation,'" he read. "You're telling the world the company's up for sale," Beattie said.

Chris was becoming increasingly agitated and turned to his cousins for support. "Lisa, did you understand that this is what this means?" he asked Lisa Steele. "Yes," she replied. "Leslie, did you?" he asked Leslie Hill. "Yes," she said. Harvey Golub directed a question to Elefante, eager for some clarity: "Does the family stand behind its statement?" he asked. Elefante replied with as much certainty as he could. "There is consensus in the family in support of this statement," he told the board.

By this time, Chris was desperate. "Is it too late for us to withdraw our statement?" he asked. Beattie had his laptop open on the conference table in front of him and had been idly scrolling through the Wall Street Journal online. As he heard Chris asking his question, Beattie's eyes jumped to a breaking headline that appeared on the site: "Bancrofts' Statement on Dow Jones Bid." The Journal's reporters had obtained an early copy of the statement and put it out. "It's too late," Beattie said. "I'm looking at the statement on the Journal's Web site."

The final reunion

The lobby of the Hilton hotel in Boston's Financial District, flanked on both ends by revolving glass doors, made it difficult for the Bancroft family members meeting inside to hide from the reporters gathered around both exits. To reach the restrooms from the windowless conference room on the ground floor in which they sequestered themselves, family members had to cross both the length and the width of the lobby, leaving ample time for ambush. The more press-averse members of the family asked hotel security for accompaniment from the conference rooms to the restrooms and back. They didn't want to be questioned. Not today.

It was a Bancroft family reunion, but one far different from that at which many of these same adults had gathered twenty-five years before around matriarch Jessie Bancroft Cox's magnetic presence in the '21' Club in New York. This time, the family, already naturally divided by its three branches, had nearly splintered under the strain of the offer thrust upon it by Rupert Murdoch and his News Corporation (NWS, Fortune 500).

It was the family's last reunion. With virtually nothing else in common except their ownership of Dow Jones & Company, the entirety of the Bancroft clan would have little reason to gather once Dow Jones was gone. Even now, as the decision loomed whether to sell the company their founder Clarence Barron had willed to them, several of them didn't deem the discussion important enough to attend in person. Vacations had been scheduled, and not even the fate of one of America's most vital newspapers would keep some in the family from their Spanish cottages, Sardinian cruises, or other relaxing summer pursuits.

The summer had begun to drag on with the efforts to find alternatives to Murdoch. In all, Dow Jones's advisers had been in touch with twenty-one potential suitors for the company but had received only one bid, from News Corp. General Electric Company and Pearson PLC had fleetingly joined together to make a bid for Dow Jones, but never followed through. Brad Greenspan, the former CEO of Intermix Media, Inc., the parent company of MySpace, and supermarket magnate Ron Burkle had teamed up to bid for a portion of Dow Jones, but nothing concrete ever materialized. Even the state-controlled Russian oil and gas giant Gazprom briefly considered an offer.

Finally, in mid-July, in what appeared to be an exhortation to the Bancrofts to wind it up, former Dow Jones CEO Peter Kann told the Journal that, while he still hoped the family would keep Dow Jones independent, "if the family is going to sell I see no point in pursuing industrial conglomerates, Internet entrepreneurs, supermarket magnates and real-estate developers. None know anything at all about journalism. As to Mr. Murdoch, at least he loves newspapers, presumably would invest in the WSJ and Dow Jones, and would seem to have little incentive to tarnish a trophy he has coveted for so long." Even Kann was pushing them into Murdoch's arms.

The week prior to the meeting in Boston, Dow Jones's board of directors had voted to accept the $5.6 billion offer from Rupert Murdoch's News Corporation. (Murdoch had agreed to assume $600 million in Dow Jones's debt, which boosted the value of the offer.)

Now, the only step left to make Murdoch the owner of Clarence Barron's old paper was the approval of Barron's descendants. The reality of the Bancroft family that damp Monday in July 2007 hardly lived up to their mythic possibilities as one of America's great news- paper families. They faced an important decision-whether to end 105 years of independence for the Wall Street Journal and add it to the media conglomeration of the Fox News television channel, the New York Post newspaper, and the MySpace social networking site.

The afternoon meeting had kicked off with a welcome from Mike Elefante, whose friendly eyes were sagging with weariness, punished as they were by the summer's proceedings.

At the meeting, Elefante's bland introduction was fitting for a man whose primary goal was to ignite no great passions in his audience. Emotion, he knew, was his enemy at this stage of the game. Standing at a scuffed podium at the front of the cramped and windowless twenty-five-by-forty-foot conference room, he stared out on the rows of stained, gold-patterned chairs filled with the family he had come to resent.

After Elefante defended the deal he had initially opposed to the assembled Bancrofts, Lisa Steele followed him at the podium. With graying curly hair and attire that announced its Burlington, Vermont, origins, Steele looked warily around a room full of the relatives she had grown tired of dealing with over the past two months. When the offer from Murdoch first surfaced, she was deeply against it. She had inherited an independent Wall Street Journal and along with it, the notion that its independence should be defended at all costs. The summer had been long and painful for her, and she rarely imagined her family would have to face this kind of hopeless scenario in her lifetime. She felt she had worked hard -- unlike many of her cousins -- to get the facts right on this deal, mainly through talking to Elefante, who was, by that day at the end of July, the only person she felt she could totally trust. She had made a list of the pros and cons of retaining Dow Jones's independence versus selling the company to Rupert Murdoch. When she looked at the lopsided lists, she felt the deal was a no-brainer.

The decision, desperate and discouraging as it seemed to her earlier in the summer, had long settled into inevitability, and by that late-July afternoon, she arrived ready to defend her view. Despite warnings from some of the Journal's reporters, Steele felt that the future without Murdoch would be much bleaker than one with him. She saw her family, through leaks to the press and indecisiveness and internal infighting, as unable to stand together.

Steele didn't realize, as she took the floor, that one of her relatives was reporting the meeting in real time to Murdoch's unofficial lieutenant Andy Steginsky. Steele told her family that she had done "her own due diligence" on the deal and had come to the painful conclusion that it was time to sell the company. Her words -- "It will be irresponsible to walk away from this deal" -- were welcomed warmly in the News Corp. camp.

Leslie Hill's opposition to the offer had blossomed over the past two months since her last meeting with Murdoch. She had been deeply affected by letters sent earlier in the summer from Wall Street Journal reporters urging her and her family members to reject Murdoch's offer. She had, by the time her family gathered for this meeting, grown entirely mistrustful of Dow Jones's advisers and many on the company's board.

When Leslie stood up after her cousin's comments, she walked to the front of the room and then stopped. "I have two speeches I could give," she said, "but I can't give either one of them." She then held up a manila envelope, a half-inch thick, stuffed with letters from Journal reporters who protested the deal and wrote to her and her cousins to urge them to reject it. "These are letters from Wall Street Journal reporters," she said, her deep voice quavering. "They wrote to urge us not to accept this offer. I could say a lot of things about this deal," she continued, "but it is their voices that matter." She was waving the manila envelope, clearly choked up. "We owe it to them not to sell."

Following Leslie was Chris Bancroft, who wore a blue baseball cap embroidered with a fishing lure and a not-so-subtle message to his relatives: Bite Me. He had hired his own lawyer and banker and was becoming annoyed at the money he was spending to explore the options he felt the company's advisers were allowing to pass by unexamined. He knew time was running short and Zannino was moving ahead with due diligence with Murdoch. If he could find a way to take a principled stand and still have the deal go through, that might solve his dilemma. He stood up and walked to the front of the room and didn't stop pacing until he finished his short talk. "We're not broken," he told his family. "Dow Jones is doing just fine, and if Rupert is offering sixty [dollars a share] then it must be worth a lot more," he said. "Selling now is like selling the milk cow for beef," he said, his voice rising.

Chris made it clear in his speech that he wasn't in favor of the offer, but he also delivered a message that showed he was as much a pragmatist as the advisers he so mistrusted. "I am going to vote no for the family shares I control, and I'm going to take the advice of my legal counsel for my votes as a trustee." The legal counsel for such a lucrative deal would almost certainly be to vote yes for the deal, Chris knew. If he voted yes for those shares, he would deliver the company to News Corp., since the vast majority of the shares he controlled were in Article III, which he oversaw as a trustee. But he couldn't bring himself to vote for this deal on his personal shares. His older brother, Hugh, was in favor of the deal, as was his niece Elisabeth Goth Chelberg, making his stance all the more controversial within his own family.

Everyone in the family realized, to varying degrees, that the power over Dow Jones and the Bancroft family's fortune lay not with the people with Bancroft blood running through their veins, but with the law firm that had advised them for so many years, Hemenway & Barnes. The earliest Bancroft trusts dated back to the mid-1930s and were established for the three grandchildren of Clarence Barron: Jessie, Jane, and Hugh. The Bancrofts hired Hemenway & Barnes in the 1940s and had relied on them for counsel ever since. Mike Elefante informed the thirty-three Bancrofts in attendance that they had a deadline of about a week from that meeting to vote on the deal.

That week was a frenzy of activity and great stress. In the days leading up to the deadline for votes, William Cox Jr. went into diabetic shock. Leslie Hill, principled to the end, resigned her Dow Jones board seat in protest of the now inevitable decision.

Chris Bancroft took a different path from his cousin. Having made it known that he was going to straddle the offer, he realized that through their endless wavering the Bancroft family had forgotten the first rule of bargaining: if you are selling, ask for more. He and others made a last stab to get Murdoch to raise his offer. By then it was too late. The News Corp. camp knew they had the company at $60 a share, not a penny more. In an embarrassing denouement, Chris tried to chisel out of News Corp. a pledge to pay his legal fees.

Over the next several weeks, the Bancrofts suffered a final ignominy. After the deal was signed, they attempted to choose their representative to the News Corp. board, the family member who was to preserve Barron's legacy. Fractious as always, the Bancrofts missed their deadline. Murdoch made the choice for them, vetoing the family's first selection and instead picking a twenty-seven-year-old opera singer, Natalie Bancroft, whose greatest qualification for Murdoch was that unlike some of her Hill and Goth cousins, she held the right surname and wouldn't raise a fuss in the boardroom.

Excerpted from War at the Wall Street Journal by Sarah Ellison. Copyright © 2010 by Sarah Ellison. Reprinted by permission of Houghton Mifflin Harcourt Publishing Company. All rights reserved. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |