Search News

FORTUNE -- By his own admission, Allan Jones of Cleveland, Tennessee, has had to tighten his belt. He apparently still has his two jets, his vintage Rolls, his Bentley, and the Maybach his son drives to high school when the boy's own car is in the shop. But Jones did have to sell the 157-foot yacht, and the $25 million ranch near Jackson Hole.

"People say I'm making all this money off of payday," Jones told reporter Gary Rivlin, "but even I'm cutting back."

"Payday," as Jones and his fellow titans call their line of work, is shorthand for the payday-loan business, which flourishes in virtually every poor neighborhood in the nation. If you're two weeks from your next payday and you're out of cash, there's a guy in an office down the street or at the strip mall happy to lend you $500 at 15% interest.

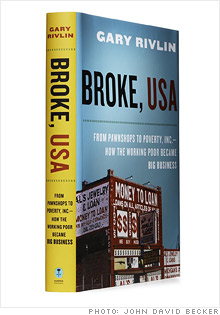

Annualized, that's an effective APR of 391%. But they usually don't tell you this. And that's the point of Rivlin's fascinating book, Broke USA: From Pawnshops to Poverty, Inc. -- How the Working Poor Became Big Business (Harper). Rivlin opens up, dissects, and eviscerates the gigantic industry of vulture finance, a world where raptors like Allan Jones (and not a few of our biggest banks) feast on the unwitting road kill of the American economy.

They try to cloak themselves in civic virtue, pointing out that no one else would give credit to people earning less than $30,000 a year. But they don't mention the 391% in that speech, either.

If you're not the sort whose blood comes to a boil because of rackets like these, you could instead read Broke USA to learn how to make a bundle by legally bilking America's poor. One tip: call your lobbying organization, as the payday lenders do, the Coalition for Fair and Affordable Lending. Another: Play "Money, That's What I Want" at your annual convention. (Honest.)

More specifically: get into the tax preparation business. First, you collect a fee for filling out a customer's 1040. Then you offer an "instant tax refund," which is not a refund at all, but a loan against the customer's anticipated refund, at an APR exceeding (but rarely stated as) 100%. And then you collect another fee -- by cashing the check you've just handed to your prey.

Is this a great country, or what? Just ask Allan Jones. Near the book's end, he does some quick math and points out that the profit from each of his payday stores is just $7.93 an hour. "That's practically minimum-wage rates," he exclaims. Of course, multiplied by the 1,300 stores in Jones's chain and the hours they're open, it comes to $23.4 million a year.

That's not minimum wage. That's robbery. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |