Search News

FORTUNE -- Alexander Hamilton founded the Bank of New York in 1784, J.P. Morgan gave his bank its eponymous name in 1895, and 31 businessmen of note established Fieldpoint Private Bank & Trust in 2008.

That last fact is unlikely to become a headliner in banking textbooks, but it makes the news here because this de novo private bank called Fieldpoint is extraordinarily unusual. Not because of its size, certainly: It has only 30 employees and is an also-ran among the 8,000 U.S. banks. In location, it's largely obscure as well, its one-and-only office sitting inconspicuously on Field Point Road in Greenwich, Conn. True, that town is rich territory for any bank; the median sale price for a Greenwich home in 2009 was $1.6 million. But it is far less the surroundings of the bank than its remarkable provenance -- those 31 people who started it -- that makes Fieldpoint unique.

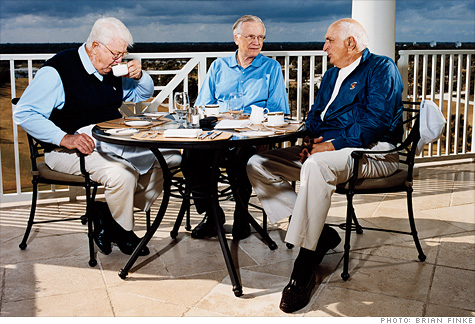

These founders (all of them indeed men) are for the most part a who's who of business, many retired, some not, and two-thirds having a link to Merrill Lynch (MER). Among the Merrill alumni are three of the company's CEOs, William Schreyer, Daniel Tully, and David Komansky, whose tenure at the top covered 17 continuous years. The non-Merrill founders include luminaries such as James Kilts, former CEO of Gillette; private equity pioneer Jerome Kohlberg; and the outspoken investment banker Kenneth Langone.

The founders -- even those lacking immediate name recognition -- had one big fact going for them as this enterprise got started: They were millionaires, irrefutably so, because each put up either $1 million or $2 million to capitalize the bank, contributing a total of $35 million. The group then pulled in private investments of another $10 million and started out -- officially opening in April 2008 -- with $45 million in capital.

And why were these specimens of the unneedy starting a bank? Basically, because they were persuaded by a few instigators -- chief recruiter Tully among them -- that the world needed a new private bank to serve people just like themselves: high-net-worth individuals wanting good service and not always getting it from their existing providers. The origins of the bank also say a powerful amount about business connections and how readily they can be tapped. (For an explanation of the links that formed Fieldpoint, see graphic.) This is in fact a case in which every man who signed up "knew somebody" and thereby ended up a founder.

For instance, Langone, who runs his own investment bank, Invemed, heard about the plans to start Fieldpoint when he was having dinner in late 2006 at Manhattan's Il Postino restaurant with Tully, Komansky, and two other former Merrill Lynchers, Joe Grano and Martin Kaplan. "I'm always looking for opportunities," says Langone, "and I said that night, 'Is there a chance I can get in?' " Grano and Kaplan asked the same. Soon after, Langone signed up his longtime friend Bernie Marcus, former CEO of Home Depot (HD, Fortune 500). And so it was that the band of founders gradually formed and got this venture going.

Success, in this case, has tagged along. Fieldpoint has grown -- virtually sprinting in 2009 and 2010 -- to $345 million in assets. It has $292 million in deposits and about $185 million in loans, most of those jumbo mortgages in the $1-million-and-up range. It also has a small wealth management business that it's working to expand. Overall, Fieldpoint is cash-flow positive right now and expects to become profitable in the next couple of months.

As the credit crisis mounted, meanwhile, many other de novo banks failed, showing such weakness that the Federal Deposit Insurance Corp. recently tightened both the capital requirements and supervisory rules applying to these startups. But most of the casualties have been "community banks," which typically are established to provide banking services to a geographical pocket that needs them and which are also prone to being undercapitalized. Fieldpoint fits neither description, unless the community meant is the kind of big money that its founders come from.

Don Musso, head of FinPro, a New Jersey bank consultant that helped Fieldpoint pull its plans together, says that it is in fact very unusual for a "wealth bank" to be established, because the FDIC has scant interest in insuring rich people. That helps explain why Fieldpoint, having succeeded in getting its banking charter, seems to lack competitors that it can be compared with. At minimum, no other bank got started by a passel of businessmen having the reputation that Fieldpoint's founders do.

As for services provided, the private banks that reside within large commercial banks are, of course, kin to Fieldpoint. One distant cousin is Brown Brothers Harriman, a private bank that has $6 billion in assets and whose history under that name goes back to 1931. For the closest comparison in services, however, says FinPro's Musso, he'd pick Boston Private Bank & Trust Co., which has $3 billion in assets and also a parent company, Boston Private Financial Holdings, whose stock is traded publicly (and which has been severely hurt by real estate loans made by another of its affiliates).

Daniel Donahue, 71, a Fieldpoint founder and today its chairman and CEO, contends that no bank is like his, and he has the history to make the argument. A tall, ramrod-straight West Point graduate who trained as a parachutist while serving in the 101st Airborne during the early 1960s, Donahue later spent 36 years at Merrill Lynch, rising in his last job to regional manager of a large area that included all of Connecticut, New York's Westchester County, and western Massachusetts. Then, in 2000, Stanley O'Neal became Merrill's heir apparent, and Donahue couldn't stand him. So he retired to his Greenwich home and began working on his golf game.

But Donahue also kept kicking around business ideas with his longtime friend, retired Merrill Lynch CEO Dan Tully, now 78. By 2006 they had come up with the idea for Fieldpoint. The two men then pulled in six others (most of them Merrill Lynch alums) to become organizers, each of the eight ready to invest $1 million but initially putting up only $25,000 to get things started.

Later, as the bank cleared its first regulatory hurdles, the eight reached out to people they knew who might have $1 million to spare -- the "ultra-affluent" is Donahue's description -- and an interest in betting it on Fieldpoint. Most especially, says Donahue, they sought "nice" people with a record of backing charitable causes (evidence, perhaps, of niceness). The gregarious Tully, who with his family had given an entire building to Stamford Hospital in Connecticut, knew an enormous number of such paragons and launched his recruiting.

In his sales talks Tully argued that Fieldpoint's opportunity lies in the failings of many existing private banks. He and Donahue had heard tales from wealthy friends of poor advice and frustrating service that descended in some extreme, and perhaps apocryphal, cases to customers being unable to get a real person on the phone when they called their banks. (Let it be noted that Fieldpoint's private bankers give their cellphone numbers to their customers and say they'll take a call 24/7.)

The other, entirely commercial argument for Fieldpoint was that the bank had a good chance of being a winning investment. John L. "Launny" Steffens, a Merrill Lynch executive until 2001 (he didn't get along with O'Neal either) and one of the eight organizers of Fieldpoint, recalls that between 2002 and 2007 a carefully planned new bank was pretty close to a sure-fire proposition. The would-be bank, he said, could expect to spend several years slogging through the regulatory process, would ultimately go into business with a book value that represented the starting capital it had raised, and after a few years of success and growth could be sold or taken public at a price of about 2½ times book value.

Unfortunately, this formula abruptly stopped working when the economic crisis hit. Bank deals have dried up, or if made at all, are carried out at distress prices. Steffens, who today heads asset manager Spring Mountain Capital, acknowledges the change in the market. But he says that prices can recover and that Fieldpoint has the option of choosing to expand. It is set up as a federal savings bank and consequently can branch into other states with relative ease, without having to seek de novo charters from new states it enters. Fieldpoint is indeed planning to expand this fall, by branching out of Greenwich into New York City.

Fieldpoint's timing in starting up in the midst of a crisis had other ramifications. Donahue says the bank gained depositors who were running from banks like Citigroup and Bank of America and saw Fieldpoint as a safe harbor. On the other hand, investors pulled back from investing and showed no signs of thinking that Fieldpoint's wealth management services deserved an exception.

Fieldpoint does not manage assets itself but instead farms the money out to money managers it has vetted -- people like Charles "Chuck" Clough, who used to be Merrill Lynch's chief investment strategist and now runs a Boston asset management firm. Investors who go through Fieldpoint pay it a fee of up to 1% on assets and also pay a fee to the outside money managers signed up, though Fieldpoint sometimes negotiates a discount from these providers.

Doing business that way and needing to build up a list of money managers to turn to, Fieldpoint in its early months almost inevitably heard from people recommending Ponzi schemer Bernard Madoff. One approach came from a man working for Fairfield Greenwich, a giant feeder fund for Madoff. In October 2008 (two months before Madoff was unmasked) this salesman sent Donahue a document explaining Madoff's "split-strike conversion" strategy and detailing his consistent monthly returns. Donahue did not think the Madoff strategy made sense and ended his talks with the salesman. Not so fortunate, however, was founder Launny Steffens, who through intermediary Ezra Merkin gave $40 million of Spring Mountain's money to Madoff. That investment, though only 4% of the firm's total, has been, of course, mostly lost.

Today, two years after Fieldpoint's start, Donahue says that about 30% of the bank's business -- "too little," he laments -- comes from its founders and about 70% from the general public. But Donahue has an exemplar among the founders to point out: his longtime Greenwich friend Reginald Brack, the retired chairman and CEO of Time Inc. (TWX, Fortune 500) (parent of Fortune). Upon hearing from Donahue about the plans to start Fieldpoint, Brack related immediately to the thought that his private bankers hadn't on occasion done him much good. "After I left Time Inc. in 1997," he says, "I realized I was getting fleeced -- paying big fees and not getting much performance." The private bankers doing the alleged shearing were at Goldman Sachs (GS, Fortune 500) and UBS (UBS), and Brack is no longer doing business with either.

Now on the board of Fieldpoint, Brack also raves about its services. The bank helped him revise an outdated estate plan, refinanced his daughter's apartment, put him together with outside money managers he likes, and holds a lot of his cash. Like many relatively small banks, Fieldpoint sometimes turns over deposits above $250,000 (the current FDIC insurance limit) to the Certificate of Deposit Account Registry Service (CDARS), which spreads the excess among its network of banks. Because the CDARS system helps to attract deposits, Brack calls it our "electric toaster."

Certainly Brack does not think of Fieldpoint as a lark, nor does any other founder among the 20 that Fortune talked to. Yet some perspective must be maintained about the bank's character, and Dan Tully supplies a little: "We started Fieldpoint in a way that would let us have fun with it. We're all friends, and we enjoy doing things together. If it wasn't successful, you would have only lost $1 million." Should Fieldpoint need more capital to grow, which is certainly a possibility, Tully thinks it could surely be raised: "If the $1 million goes to $2 million, it's not going to change anyone's life." That's a breezy way to describe a venture apt to provide a bit more wealth to men already well acquainted with its feel. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |