Search News

NEW YORK (CNNMoney.com) -- Stocks ended a volatile session lower Friday, with the major indexes ending at new 2010 lows in the aftermath of a weaker-than-expected June jobs report.

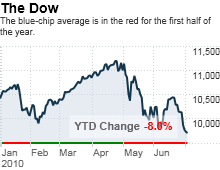

The Dow Jones industrial average (INDU) lost 46 points, or 0.5%, after having been on both sides of the unchanged line through the session. The Nasdaq (COMP) composite slipped 9 points, or 0.5% and the S&P 500 (SPX) index dropped 0.5% as well.

The Dow and Nasdaq ended at fresh 8-month lows and the S&P 500 at a 9-month lows.

Stocks slid through most of the day as investors digested the jobs report ahead of a long holiday weekend. All U.S. financial markets are closed Monday in observance of Independence Day.

Stocks have tumbled in recent weeks, with the S&P 500 down more than 15% since the April highs on worries about the European debt crisis and U.S. economy. Stocks lost ground Thursday following worse-than-expected economic readings on manufacturing and housing.

On Friday, the jobs report provided little relief, showing a rise in private sector hiring that was smaller than expected, and a drop in the overall number of jobs.

"The rise in private-sector payrolls shows we are moving in the right direction, but just not fast enough to keep up with all the headwinds in the economy," said Jane Caron, chief economic strategist at Dwight Asset Management.

Jobs report: Employers cut 125,000 jobs from their payrolls last month, more than the 100,000 job cuts expected by economists surveyed by Briefing.com.

Most of the decline was a result of the 225,000 temporary Census employees that were let go after the conclusion of the survey.

On the upside, the private sector added 83,000 jobs, the report showed. However, that was shy of the 112,000 economists had been expecting.

The unemployment rate, generated by a separate survey, dropped to 9.5% from 9.7% in May. Economists thought it would rise to 9.8%.

Factory orders: In the day's other economic report, the Commerce Department said factory orders fell 1.4% in May after rising 1% in April. Economists thought orders would drop 0.6%.

On the move: Stock declines were broad based, with 27 of 30 Dow components falling, led by Caterpillar (CAT, Fortune 500), Chevron (CVX, Fortune 500), IBM (IBM, Fortune 500), JPMorgan Chase (JPM, Fortune 500), 3M (MMM, Fortune 500) and Verizon Communications (VZ, Fortune 500).

Bank stocks were hit hard, with the KBW bank sector index sliding 2%. Truckers, railroads and airlines were hit by worries about the economic slowdown, sending the Dow Jones transportation average lower.

World markets: European markets were mixed, with Britain's FTSE 100 adding 0.7%, Germany's DAX losing 0.4% and France's CAC 40 gaining 0.3%.

Asian markets were mixed, with Japan's Nikkei rising 0.1%, Hong Kong's Hang Seng falling 1.1% and the Shanghai Composite rising 0.4%.

Commodities: U.S. light crude oil for August delivery fell 81 cents to $72.14 a barrel on the New York Mercantile Exchange.

COMEX gold for August delivery rose $1 to $1,207.70 an ounce.

Currency: The euro gained versus the dollar but remained above the four-year low of $1.188 hit earlier in the month. The dollar was up slightly versus the yen.

Bonds: Treasury prices fell, raising the yield on the 10-year note to 2.96% from 2.93% late Thursday. Treasury prices and yields move in opposite directions.

Market breadth: Market breadth was negative. On the New York Stock Exchange, losers beat winners two to one on volume of 540 million shares. On the Nasdaq, decliners beat advancers two to one on volume of 920 million shares. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |