Search News

NEW YORK (CNNMoney.com) -- Now that Goldman Sachs has likely put its troubles with the Securities and Exchange Commission behind it, can the company finally breathe a sigh of relief?

Not just yet.

|

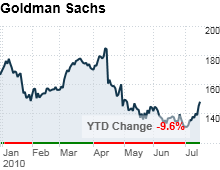

| Shares of the company have struggled so far this year amid serious questions about Goldman's reputation as Wall Street's top firm. |

On Tuesday, Wall Street's most-gilded firm will report its second-quarter results. Analysts however, have been dramatically cutting forecasts for Goldman Sachs in recent weeks amid concerns that the combination of market volatility and economic tremors will hurt profits.

Current expectations are for the company to earn just under $1.3 billion, or $2 a share, according to Thomson Reuters. That's down 64% from the $3.4 billion it earned a year ago.

Less-than-impressive numbers from some of Goldman's closest rivals is shaking investor confidence even further.

JPMorgan Chase (JPM, Fortune 500), for example, reported a double-digit decline in trading revenues when it delivered its results on Thursday.

Both Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500) reported similar declines.

That prompted FBR Capital Markets analyst Steve Stelmach to cut his estimates for Goldman Friday.

And while Goldman (GS, Fortune 500) has taken part in several key initial public offerings recently, including that of electric car maker Tesla Motors (TSLA) and exchange operator CBOE Holdings (CBOE), investment banking activity remains sluggish.

Revenue from stock and debt activity worldwide fell 24% to $7.9 billion during the second quarter from $10.4 billion in the previous quarter, according to research firm Dealogic.

But the troubles for Goldman don't appear to end there. With a significant presence in the United Kingdom, the company is also likely to take a charge worth several hundred million dollars as a result of the British government's decision earlier this year to tax bankers' bonuses.

At any other time, Goldman might have been able to pretty up its results by lowering the amount of money it sets aside for employee pay this quarter. The only problem, however is that the firm dramatically lowered the amount it added to its compensation pool last quarter.

In order to pay its famously large bonuses at year end, experts suggest the company won't have that option this time around.

"They made the decision in the first quarter to start out at much lower levels than they ever had before," said William Blair analyst Mark Lane. "I don't think they can do much there."

What could weigh on Goldman's results even further is Goldman's proposed $550 million settlement with the SEC. Analysts expect the company to take a charge this quarter for the full amount. That would be about 92 cents a share, according to FBR's Stelmach.

Executives from the company are also likely to face tough questions Tuesday about the impact of the forthcoming financial regulatory bill.

Some analysts have suggested that Goldman could be among the hardest hit by changes to derivatives trading and the so-called "Volcker rule", which would limit how much banks can invest in private equity and hedge funds.

But with the bill expected to be signed into law by President Obama next week and official rules still several months away, Goldman will be able to breathe easier knowing it doesn't have to answer those tough questions just yet.

"There is no way they will quantify anything," said Lane. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |