Search News

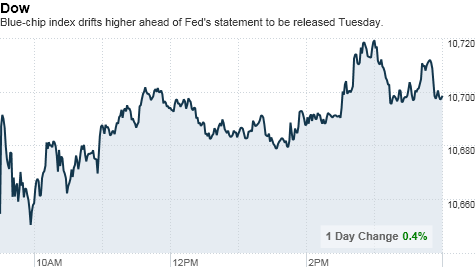

NEW YORK (CNNMoney.com) -- Stocks ended higher Monday as investors signaled modest optimism in the economic recovery, ahead of a highly anticipated statement from the Federal Reserve.

The Dow Jones industrial average (INDU) rose 45 points, or 0.4%, to close at 10,698.75. The S&P 500 (SPX) gained 6 points, or 0.6%, to end at 1,127.79, and the Nasdaq (COMP) added 17 points, or 0.8%, to close at 2,305.69.

Stocks got a boost from expectations that the Fed would strike a more dovish tone after its meeting Tuesday. "Following the payrolls report on Friday, we may see a softer approach from the Fed," said David Jones, chief market strategist at IG Markets in London.

But trading remained quiet as the summer doldrums kicked in. August is historically a down month for the market with low trading volume and many market participants staying on the sidelines.

NYSE volume was only 640 million shares in late trade Monday, with advancers topping decliners about five to two. By comparison, daily volume in July averaged about 950 million shares.

"We've seen some moves up and down but very little in the way of direction," said Jones.

Wall Street ended last week on a negative note, after the government said the economy lost 131,000 jobs last month. But all three major indexes managed to eke out gains for the week.

While the overall jobs number was dismal, a "positive but overlooked" part of the report was also supporting stocks Monday, said Paul Radeke, wealth advisor at KDV Wealth Management.

"After a long time unemployed, the data show some people are starting to consider taking jobs below their old pay scales," Radeke said. "That should help the numbers in the short term."

Eyes on the Fed: With no major economic reports on Monday, investors were already looking toward Tuesday's Federal Reserve meeting on interest rates.

The central bank is widely expected to hold interest rates at historic lows near 0%, a policy that has been in place since December 2008. Investors are eager to see what additional steps the Fed is willing to take to help support the economic recovery, which is turning out to be weaker than many analysts had expected earlier this year.

Companies: HP (HPQ, Fortune 500) shares fell Friday after chief Mark Hurd resigned in the wake of a harassment claim was made against him and the company. Shares ended 8% lower Monday.

Apple (AAPL, Fortune 500) confirmed over the weekend that Mark Papermaster, the former IBM executive in charge of the iPhone division, has been replaced by Bob Mansfield. Shares were flat Monday.

Skype, the Internet calling service, announced early Monday that it had filed for a $100 million initial public offering. Skype separated from eBay (EBAY, Fortune 500) in September 2009.

Goldman Sachs (GS, Fortune 500) lost more than $100 million on three separate days during the April to June quarter, according to documents the Wall Street giant filed with the Securities and Exchange Commission, after posting a remarkable "perfect" quarter in the previous three months. But shares stayed flat Monday.

Chrysler said Monday that its its net loss was $172 million in the second quarter, but the company expects to raise guidance for 2010.

Google (GOOG, Fortune 500) and Verizon (VZ, Fortune 500) unveiled a joint proposal for an open Internet standard known as "Net neutrality" on Monday. The proposal would give the Federal Communications Commission authority to regulate wired broadband Internet providers to ensure consumers have access to all legal content and applications on the Internet.

World markets: European markets rallied, with Britain's FTSE 100, France's CAC 40 and Germany's DAX all ending about 1.5% higher.

In Asia, Japan's Nikkei finished the session 0.7% lower. The Shanghai Composite and Hang Seng both gained about 0.5%.

Currencies and commodities: The dollar gained slightly against the British pound, but weakened against the euro and Japanese yen.

Oil futures for September delivery rose 79 cents to settle at $81.48 a barrel.

Gold futures for December delivery gained $3.40 to $1,208.70 an ounce.

Bonds: Prices for U.S. Treasurys were little changed. The yield on the 10-year note was 2.83%. The government is auctioning $74 billion worth of 3-, 10- and 30-year debt this week as part of its quarterly refunding. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |