Search News

FORTUNE -- The rumors persisted of Lehman Brothers' being taken over again, and it was against such a background that Dick devised his pièce de résistance.

Fending off the external threat would involve a lot of bluff to convince people that Lehman Brothers was far stronger than it was. It would have to ooze confidence if it was to make its way. At some stage, Fuld seemed to have decided that the best way to do this was by completely revamping his own image, even, if possible, his personality.

In May 1995 BusinessWeek magazine published an interview with Fuld, just a year after he had led Lehman Brothers into its renewed status as an independent firm. "Free at Last" read the headline, mimicking the cry from the 1960s of the late civil rights leader, Martin Luther King, Jr.

Fuld reported that he had just returned from Israel, where Lehman Brothers had opened an office. Though Fuld was Jewish, this was his "first major trip" there. The Israelis' spirit impressed him, their sense of "we are all in it together," by which he may have meant being surrounded by a collection of hostile neighbors. This was also "the guts" of Lehman Brothers' culture, he said. On the other hand, company togetherness no longer included the one thousand people that Fuld had laid off in the previous year.

An accompanying photograph captured the key theme of the article. It showed a sideways-on shot of a dark-suited Fuld reclining in a Victorianesque armchair. With his head turned straight to the camera and arm bent at the elbow, it looked as if he was about to make a thoughtful, even philosophical contribution to a conversation. In his trader days Fuld would not have been caught at work posing pensively in an old armchair. Rare pictures of him from past times usually had him sitting at a trading desk and computer screens, his tie tightly tied and his collar fiercely buttoned up, jacket off . Such old snapshots give the impression of a man pausing just long enough for the photographer to get his picture before getting back to work.

But evidently, Dick was no longer a trader. "For the clients we're targeting," he said of Lehman Brothers' ambitions, "we want to be their top 1 or 2 banker." This was a radical departure by a man who had once spoken of those "fucking bankers." Fuld, it appeared, had discovered business was not simply a matter of deals and transactions but of clients and relationships. On his recent trip to Israel, he had apparently also taken the road to Damascus.

He was not alone in his itinerant ways. In a 1996 piece for the New York Times entitled "The Death of Sherman McCoy," Michael Lewis said others were en route from the raucous '80s: "[T]hey read the books, saw the movies, studied the lawsuits and decided on balance that it paid them to clean up their acts and pretend to be modest like everyone else." Some big-time traders left their jobs at investment banks to join new institutions such as hedge funds. Hedge funds were pools of unregulated capital, a term for rich people's money invested in lucrative places where the government would not interfere. They were sometimes back-street operations, albeit in quite exclusive back streets. London's posh Mayfair

district, nestled between Piccadilly and Park Lane, became a hedge fund haven. Some traders-turned-hedge-fund types had changed their style: "The very same people who seemed unable to function without cigars, suspenders and thousand-dollar suits were suddenly turning up for work in sneakers." Not all, of course, because by and large, Wall Street firms encouraged formal wear, but the indications were that the transformation was more one of image than substance.

As far as Dick was concerned, some people guffawed: The idea of his turning into a client-relationship man was tantamount to Jack Welch, the hard-nosed head of General Electric, discovering his touchy-feely side. Was this a ruse on Dick's part or did he believe it? Would the slam-bang mentality of the modern market even allow such a thing? But in the can-do trader's mind, to wish for something was as good as to have it done. And after all, Dick was, at his heart, a trader, albeit one who had willed himself to become a banker.

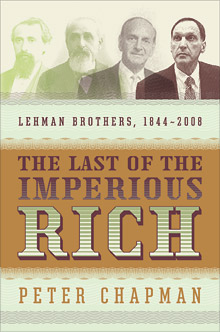

--Adapted from The Last of the Imperious Rich: Lehman Brothers, 1844-2008 by Peter Chapman by arrangement with Portfolio, a member of Penguin Group (USA), Inc., Copyright © 2010 by Peter Chapman. ![]()

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |