Search News

Click the chart for current bond prices and yields.

Click the chart for current bond prices and yields.

NEW YORK (CNNMoney.com) -- Treasury yields sank Tuesday as investors responded to a disappointing report on consumer confidence and the U.S. auctioned $35 billion in 5-year notes.

Investors flocked to the safe haven investments following a report that consumer confidence slumped to its lowest level in 7 months in September. Yields remained under pressure amid a weekly offering of $100 billion in U.S. debt.

Since Treasurys are backed by the U.S. government, they are viewed as low-risk investments. Demand for government debt is typically stronger during times of uncertainty.

"The hope has been that the consumer is coming back and will help get the economy's engine running again and spur job creation," said David Coard, head of fixed income trading at the Williams Capital Group. "But instead we're seeing consumer sentiment is at multi-month lows, which is adding to the mounting evidence that's showing the economy is still weak."

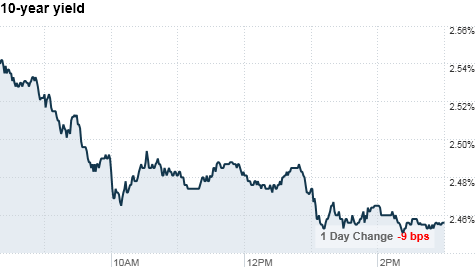

What yields are doing: The yield on the benchmark 10-year note fell to 2.46% from 2.53% late Monday. Bond prices and yields move in opposite directions.

The yield on the 30-year bond ticked down to 3.67% from 3.72%. The 5-year note dropped as low as 1.24%, the lowest since December 2008. That compares with 1.29% late Monday.

The 2-year note's yield was unchanged at 0.43% from 0.44%. It continues to hover near its record low of 0.42% hit last week.

What's on tap: The government sold $35 billion in 5-year notes, the second in this week's sales of $100 billion in newly-printed Treasurys.

Investors submitted bids totaling $103.3 billion at Tuesday's auction. The bid-to-cover ratio, a measure of demand, was 2.96. That compares with 2.83 at the last 5-year sale in August.

On Monday, the government sold $36 billion in 2-year Treasurys and will conclude with a $29 billion auction of 7-year notes Wednesday.

Investors typically opt to cheapen Treasurys and in turn drive yields higher in anticipation of new supply. But concerns about the economic recovery continue to trigger a strong bid for U.S. debt. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |