Search News

Click chart for more bond market data.

Click chart for more bond market data.

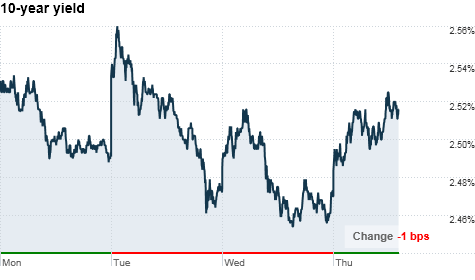

NEW YORK (CNNMoney.com) -- Treasuries continued to trade in a narrow range Thursday as investors remained on the sidelines in anticipation that the Federal Reserve will soon take action to stimulate the economy.

Yields for the benchmark 10-year note edged higher to 2.52% from 2.48% late Wednesday. The 2-year note's yield held steady at 0.36% and 5-year note's yields rose to 1.13%. The yield on the 30-year bond inched up to 3.92%.

Yields have fallen into a holding pattern this week as traders take a wait-and-approach leading up to the Fed's next policy meeting next month.

Investors have pushed Treasury yields lower in anticipation that the Fed will launch a second round of asset purchases -- or so-called quantitative easing -- in an effort to stimulate the economy at the conclusion of its two-day meeting Nov. 3.

"Yields haven't moved much because we are waiting for more clarity from the Fed," said Richard Bryant, head of Treasury trading at MF Global. He added that investors are looking for details related to the size, timing and execution strategy for the central bank's asset purchases.

Bryant said traders will likely push yields slightly lower to make room for new supply, but major moves won't come until the Fed outlines its next move.

The Treasury Department announced Thursday that it will auction $109 billion in shorter-term notes and Treasury Inflation-Protected Securities next week, beginning with the sale of $35 billion in 2-year notes on Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |