Search News

Click the chart for more on CSTR stock.

Click the chart for more on CSTR stock.

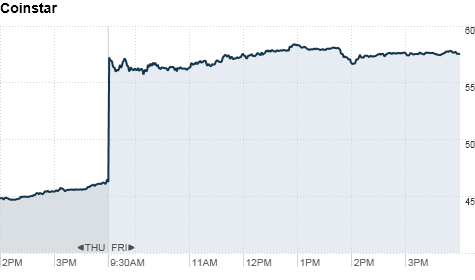

NEW YORK (CNNMoney.com) -- Shares of Coinstar, the owner of Redbox DVD rental kiosks, surged almost 25% on Friday after the company reported earnings that topped expectations.

Late Thursday, Coinstar (CSTR) said that its net income for the third quarter fell 53%. But earnings came in at 66 cents a share, beating the 50 cents expectation from analysts polled by Thomson Reuters.

Shares closed 24.5% higher Friday.

Coinstar, founded in 1993, has traditionally focused on its network of coin-counting machines in supermarkets. It has been a slow and steady cash cow, but Redbox is quickly taking over the company's growth.

Coinstar's revenue leaped 42% over last year to $380.2 million, driven by Redbox's 54.2% growth to almost $306 million.

By comparison, coin machine revenue ticked up just 7.3% to $75 million.

Customers have responded well to the DVD vending machine model. Redbox movies rent for just $1 a day plus tax, and the company announced in September that it had rented its 1 billionth movie.

Coinstar bought 47% of Redbox in 2005 and obtained the remainder in 2009. It was a shrewd move. The company's stock is up a whopping 107% year-to-date.

Rival Netflix (NFLX) has had an even stronger year: Its stock is up 214% so far in 2010. Last week, the movie rental-by-mail company said it added 1.9 million subscribers in its third quarter. Netflix also predicted growth in online streaming video.

Though Netflix is the market leader for quick and cheap DVD rentals, Coinstar's Redbox is holding its own. On Thursday, the company also forecast fourth-quarter, full-year and 2011 earnings that were stronger than Wall Street's estimates. ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |