Search News

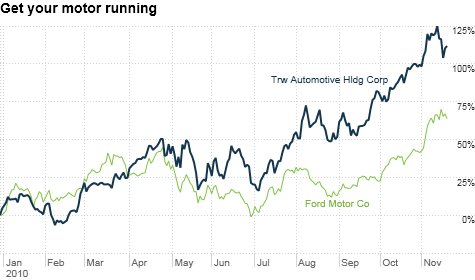

Ford's stock has been on fire this year. But TRW is one of several auto parts suppliers that have outperformed Ford.

Ford's stock has been on fire this year. But TRW is one of several auto parts suppliers that have outperformed Ford.

NEW YORK (CNNMoney.com) -- In the tech world, many pros think that it's better to buy the stocks of companies that make components for computers, phones and other gadgets.

Is the same true for the suddenly red-hot auto sector?

With GM (GM) making a splashy return to the public markets Thursday and Ford's stock enjoying an amazing run thanks to improving sales and profits, it's reasonable to wonder if auto parts makers could also benefit.

The short answer is yes .In fact, shares of several top auto parts companies, such as Magna International (MGA), BorgWarner (BWA), TRW Automotive (TRW, Fortune 500) and Tenneco (TEN, Fortune 500), have done even better than Ford's stock this year. And Ford (F, Fortune 500) is up 65% in 2010.

That means investors have to do their homework. If you chase all the stocks in the group on the hopes that more good news from GM and Ford will rub off on the suppliers, you may be disappointed.

It's important to remember just how dire things seemed for the auto parts companies when Detroit's Big Three were dealing with the worst of the credit crisis and recession.

Some auto experts feared that many auto parts companies would go out of business if the government did not bail out GM and Chrysler. The worry was that a failure of GM and/or Chrysler could set off a huge ripple effect that would cause the loss of hundreds of thousands, if not more, jobs in the auto sector.

That fortunately did not happen. But even with the taxpayer rescue of GM and Chrysler, some auto parts companies still wound up being forced into bankruptcy themselves.

Visteon filed for Chapter 11 in 2009. Ditto for Lear (LEA, Fortune 500). Both have exited bankruptcy this year though. And American Axle & Manufacturing (AXL) barely avoided bankruptcy last year.

So the rally in auto parts companies may simply be a reflection of the fact that more Chapter 11 filings (or worse) are now probably off the table.

"The auto parts sector has had a sharp rebound. At some point, companies were priced to go out of business. They didn't go out of business," said Efraim Levy, an equity analyst with Standard & Poor's in New York.

David Whiston, an equity analyst with Morningstar in Chicago, agreed.

"I was more optimistic on auto parts companies in 2009. That was the time to get in," he said. "Many companies were trading at absurdly low prices then. Now, they all look pretty expensive."

But Brian Sponheimer, an analyst with Gabelli & Co. in Rye, N.Y., said it's unfair to lump all the companies together. He added that while the big move in many of the stocks in 2009 might have been due more to relief that a catasrophe had been averted, the stock gains in 2010 are based on fundamentals.

"What is happening this year is that suppliers, for the most part, were able to nimbly restructure their balance sheets and cut costs," Sponheimer said. "As a result, many of the companies have reached a level of profitability that was impossible in 2008 when auto sales were slumping."

So investors just need to be selective. Levy said TRW, Johnson Controls (JCI, Fortune 500) and Gentex (GNTX) are among his top picks. Whiston said he thinks BorgWarner and Johnson Controls are the best companies in the sector.

Sponheimer added that investors should focus on the parts companies that have the most to gain from a shift to more fuel-efficient vehicles. He said BorgWarner, Tenneco and Federal-Mogul (FDML) are all leaders in making engine parts and exhaust systems that help reduce emissions.

Yes, it's fair to worry anytime a stock has run up dramatically in a short period of time. But as long as Ford and GM continue their comebacks, that should be good news for the top auto parts suppliers.

Levy conceded that he's only worried about high valuations for some companies, most notably tire makers Goodyear (GT, Fortune 500) and Cooper (CTB). He's not concerned that the resurgence in auto sales will end. Levy said he's actually more bullish on the outlook for the sector than he's been in a long time.

Auto production globally should rise significantly over the next few years thanks to a rebound in the United States and strong demand from emerging markets like China. Sponheimer thinks worldwide auto sales could increase from an estimated 68 million this year to as much as 86 million to 88 million by 2015.

So while GM and Ford get all the attention from Wall Street, the companies that make the guts for their sedans, trucks and SUVs may be the better bet.

"There may be some speed bumps along the way but I have tremendous confidence in the auto parts suppliers," Sponheimer said.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney.com, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |