Search News

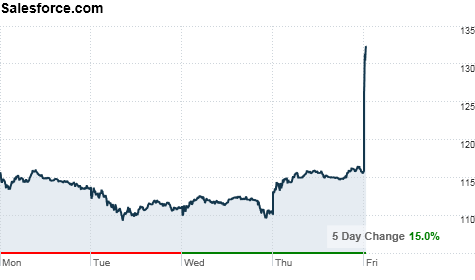

NEW YORK (CNNMoney.com) -- Shares of Salesforce.com soared to a record high Friday morning after the company delivered sales that far exceeded analysts' expectations and a bullish forecast for the current quarter.

Salesforce (CRM) rose 17% to an all-time high of $134.90 a share in morning trading.

Salesforce said late Thursday that its customer base grew by 28% compared last year in the quarter ended Oct. 31, and sales rose 30%. The San Francisco company provides hosted, "cloud" software for corporations, with a focus on customer relationship management (CRM).

The company expects the good news to keep on coming. Salesforce forecast that its revenue in the current quarter would be in the range of $447 million to $449 million. That's 5% above analysts' median estimate of $428 million, according to a survey conducted by Thomson Reuters.

Sales will come close to $2 billion in 2012, CEO Marc Benioff said in a prepared statement.

Salesforce continues to grow strongly abroad, even as other tech companies have reported weakness in foreign countries.

"The company is simply executing flawlessly into a huge market opportunity," Patrick Walravens of JMP Securities said in an analyst note. "The adoption of computing as a service is accelerating in other countries and Salesforce.com, as the largest computing as a service company, stands to benefit from this trend." ![]()

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |