Search News

NEW YORK (CNNMoney.com) -- Merriam-Webster.com defines a fad as "a practice or interest followed for a time with exaggerated zeal." Some would say that the UGGs, those bizarre-looking Australian sheepskin boots, fit that description to a T.

But can something still be considered a fad if the time that the exaggerated zeal winds up lasting for a period of years?

|

| Deckers has made a name for itself in the fashion world with the popular line of UGG boots. |

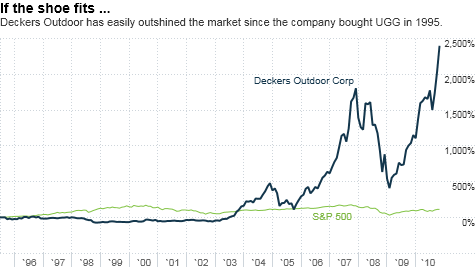

Deckers Outdoor Corp. (DECK), the company that owns the UGG brand, has been a Wall Street darling for nearly two decades now. The stock is up a mind-blowing 2400% since the company announced its intention to buy UGG in June 1995. Shares have doubled this year alone.

So is now the time to bet against Deckers? After all, fashion is arguably the most fickle business out there and trends can change on a dime. That's exaggerated in the shoe business. Remember when Crocs (CROX) were all the rage?

Crocs has had an admirable comeback this year. Its stock is up almost 200%. But shares of the plastic shoe maker are still trading over 75% below the all-time high they hit in October 2007.

But if you look at the fundamentals for Deckers, it's easy to understand why investors are so excited. Earnings have increased at an average of 30% a year for the past five years. Analysts are forecasting that profits will rise another 24% annually, on average, over the next few years.

With that in mind, some analysts said that Deckers still looks like a good stock to buy now. Sam Poser, an analyst with Sterne, Agee & Leach in New York, said that investors should no longer dismiss Deckers and the UGG brand as mere footwear fashion fads.

"When people think of UGG, they tend to think of the iconic boot. But there is so much there now, including slippers for men and kids and water-proof shoes," Poser said.

He added that Deckers also owns the Teva brand of sandals. That business only accounts for about 5% of the company's total sales (UGG makes up a whopping 92%) but Teva has enjoyed a strong rebound lately. Teva sales rose 52% in the third quarter.

Another positive for Deckers is it looks like short sellers are slowly giving up the fight against the stock, a possible realization that Deckers is for real and is not just another bubble waiting to burst.

As of late-October, the percentage of available Deckers shares being held short was about 8%. That's way down from a level of 15% to 20% a few years ago, Poser said.

There's another good reason the shorts may be throwing in the towel on Deckers. The stock still only trades at about 17 times 2011 earnings estimates.

That isn't exactly a dirt-cheap Payless Shoe kind of valuation. But it's not a ridiculously sky-high Manolo Blahnik type price for the stock either -- especially given its strong growth potential.

Still, investors should always be somewhat wary of hot momentum stocks. And if you've owned Deckers for a long time, it may not hurt to take some money off the table -- or even completely cash in.

That's exactly what investment firm Al Frank Asset Management of Laguna Beach. Calif. just did. In the company's Prudent Speculator e-mail note to clients Friday, analysts said they "reluctantly said goodbye" to Deckers.

The Al Frank analysts wrote that the stock was one of the firm's "biggest winners ever." They indicated they first bought it in May 2001 at a price of $1.31 a share and sold their remaining stake at a price no lower than $66.83.

The analysts conceded that "the top and bottom lines at the UGG purveyor have for years defied the gravity that usually deflates most companies operating in the fickle fashion footwear biz" and that they expected the strong growth to continue. But they added that "the shares have become too richly priced to justify a continued hold."

You can hardly blame the firm for taking profits after a more than nine-year investment that generated gigantic returns.

But another analyst argues that the stock isn't even as pricey as estimates indicate when you consider that Deckers has had a history of issuing conservative guidance and subsequently blowing away analysts' projections.

As strange as it may sound, Deckers could very well be the Apple of the shoe business.

Taposh Bari, an analyst with Jefferies & Co., wrote in a research note last week that he thinks current revenue and earnings estimates for 2011 are too low. He also points out that the company has a pristine balance sheet, with $250 million in cash and no debt.

Bari estimates Deckers will finish next year with $350 million in net cash. When you factor that into the equation, he argues that the core Deckers business is trading at just 10 times 2011 estimates.

Sure, many still think the UGG is a fashion faux pas. One definition for UGG on the snarky Urban Dictionary website is that they are "hideously unattractive footwear named after the mind-possessing ugg gnomes living inside the thick material who convince girls that the boots actually look good with skirts."

But there is nothing hideously unattractive about shares of Deckers.

- The opinions expressed in this commentary are solely those of Paul R. La Monica. Other than Time Warner, the parent of CNNMoney.com, and Abbott Laboratories, La Monica does not own positions in any individual stocks. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |