Search News

For more premarket data, click chart

For more premarket data, click chart

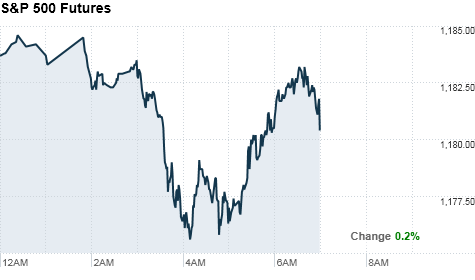

NEW YORK (CNNMoney.com) -- U.S. stocks were poised for a higher open Wednesday, getting a lift from the latest jobless claims data on the last trading day before the Thanksgiving holiday.

But a dour durable goods order report and ongoing worries about the eurozone kept the enthusiasm in check.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were higher ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks got slammed Tuesday -- with all three major indexes losing about 1.4% -- amid a trifecta of bad news: Violence on the Korean peninsula, expanding concerns about Europe's debt crisis, and the Federal Reserve's dour outlook.

But world markets, which sparked Tuesday's sell-off, stabilized overnight as investors moved beyond Korea and resumed their 'eurozone watch,' according to Art Hogan, chief market strategist at Jefferies & Co.

In the wake of deal to bail out the Irish banking sector, the game of sovereign debt Whac-A-Mole continues, with attention now shifting to Portugal and Spain, both of which are far from out of the woods.

The holiday-shortened week has packed Wednesday's session with a full docket of economic reports: personal income, durable goods, weekly jobless claims and new home sales. Trading is expected to be light with many on Wall Street taking a four-day weekend, however, light volume tends to bring volatility.

Financial markets will be closed Thursday and will close at 1 pm ET on Friday.

After the holiday, investors will be focused on retailers to see how sales fare on Black Friday. It's considered the first shopping day of the critical holiday retail period, and a key barometer of how the next six weeks will pan out.

Economy: Before the start of trade, the Commerce Department reported a surprising decline in orders for durable goods for October.

The government reported a 3.3% decline in orders for items meant to last three years or more. Economists polled by Briefing.com had projected orders would increase by 0.4% in October.

The Department of Labor released weekly new jobless claims, which came in much better than expected. The number of Americans filing for unemployment benefits totaled 407,000 last week. The Briefing.com consensus of economists had forecast 442,000.

The Commerce Department also released the latest data on personal income and spending. Personal income rose 0.5% in October, slightly outpacing the expected increase of 0.4% forecast by a consensus of economists.

Personal spending rose 0.4% in October, falling short of expectations, which called for a 0.6% increase.

Later on Wednesday, the Commerce Department will report data for new home sales in October. Analysts expect they rose to an annual rate of 314,000 last month from 307,000 in September.

World markets: European stocks were higher in morning trading. Britain's FTSE 100 gained 0.6%, the DAX in Germany rose 1.3% and France's CAC 40 ticked up 0.3%.

Asian markets ended mixed. The Shanghai Composite gained 1.1% and the Hang Seng in Hong Kong rose 0.6%, while Japan's Nikkei dropped 0.8%.

Companies: Business software maker SAP (SAP) said after Tuesday's close that it has been ordered to pay $1.3 billion to Oracle for copyright infringement by its now-defunct software maintenance unit. SAP shares dipped in premarket trading. Oracle (ORCL, Fortune 500)'s stock edged up 2%.

Deere (DE, Fortune 500), the tractor and lawn mower maker, reported earnings per share of $1.07, topping analyst expectations. Shares were little changed in premarket trading.

High-end jewelry chain Tiffany & Co (TIF). reported earnings per share of 46 cents per share, topping the 37 cents per share expected by analysts. The company cited strong sales in Asia for its better-than-expected performance. Shares of Tiffany moved higher in premarket trading.

Currencies and commodities: The dollar strengthened against the euro and the Japanese yen, but dropped against the British pound

Oil for January delivery gained 49 cents, rising to $81.74 a barrel.

Gold futures for December delivery fell $4 to $1,373.60 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury dropped, pushing the yield up to 2.84% from 2.76% late Tuesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |