Search News

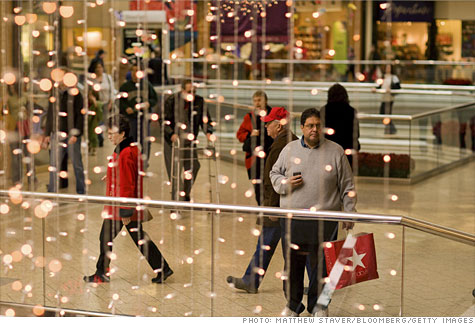

FORTUNE -- Retailers are expecting a somewhat cheerful holiday season this year. While consumer demand continues to be relatively weak, retailers -- for the most part -- have learned to work around that hurdle keep and profits growing. The National Retail Federation predicts that sales this holiday season will rise moderately by 2.3% to $447.1 billion -- higher than last year's 0.4% increase and a big improvement from the 3.9% decline in winter 2008.

Many major retail chains learned painful lessons from that fateful winter two years ago. For one, although retailers have raised their inventory slightly amid the economic recovery, major retailers dramatically cut inventory to save costs and avoid steep discounts seen at the height of the financial economic recession.

Soon after the latest recession hit at the end of 2007, JC Penney (JCP, Fortune 500) and Kohl's (KSS, Fortune 500), in particular, dramatically cut inventory. In 2010, inventory at Kohl's made up 22.2% of assets, down from the 28.5% seen at the end of 2007, according to Sageworks, a financial analytics provider. JC Penney's inventory as a percentage of assets fell to 22.2% in 2010 from 26.8% at the end of 2007.

What's more, weeks before the traditional start of the Christmas shopping season on Black Friday, sales promotions have been in full swing as retailers try to lock an early share of holiday spending. JC Penney offered 60% off selected items one Saturday earlier this month, while rival Kohl's had a three-day "Power Shopping Sale," the Financial Times reported. And free shipping through online sales has become almost the industry standard as the holiday season approaches.

Rising commodities hit the consumer

But apparel retailers still face a powerful headwind: the skyrocketing price of cotton. Even while executives find ways to get the price-conscious consumer to buy more through post-recession sales strategies, the upcoming year will probably force many to raise prices, if they haven't done so already. Cotton futures have risen nearly 80% since July and expected to remain high. Because the global recession kept production of cotton relatively low, supply is struggling to keep up with huge demands from China, in particular. This, and other factors including higher demand for cotton as the U.S. economy recovers, has pushed up prices for the commodity.

Manufacturers could turn to materials other than cotton. The Bon-Ton chain is switching from 100% cotton to acrylic blends for items like sweaters, The New York Times reported. Bon-Ton is raising private-label fashion items by up to a dollar this spring and prices could rise further next fall.

But more often, they are simply passing those costs to the consumer. Fortune recently hosted a panel of retail executives including Les Berglass of the executive search firm Berglass and Associates, John Howard, CEO of the private equity firm Irving Place Capital, Mindy Grossman, CEO of HSN (HSNI), and Richard Dickson, CEO of branded business for Jones Group (JNY). Dickson, whose company owns Nine West, Anne Klein and other brands, warned that the rising commodity costs will have to be passed on. Jones expects a relatively strong holiday shopping season, with sales forecasted to rise by the high single digits. But the cheer will be short-lived, as the company has announced a 10% rise in apparel prices after the New Year to help offset the rising cost of cotton.

Dickson's remarks underscore the challenges facing retailers, as they are coping with blows from both sides of the business: a weary consumer and rising costs.

The nagging question is: Will consumers pay more for clothes? Dickson and Grossman of HSN both said that consumers continue to spend but they are just much more choosy about their purchases. HSN, which sells everything from accessories to home furniture in catalogs, on television and the web, continues to see demand in the affordable luxury segment -- higher-end items offered below designer prices.

A year from now, weak demand for the latest fashions will probably be a smaller problem for retailers than it is today. But if shoppers want it at a low, low price, they may have to be willing to wear more polyester. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |