Search News

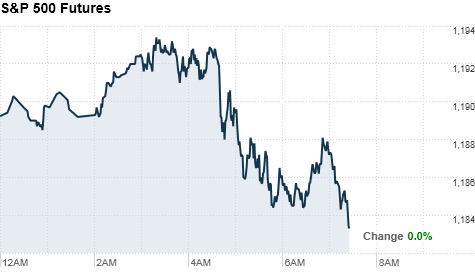

Click chart for more premarkets data.

Click chart for more premarkets data.

NEW YORK (CNNMoney.com) -- U.S. stocks were expected to open little changed Monday as investors reacted to news of an €85 billion bailout of Ireland and anticipate this week's economic reports, including the monthly jobs report.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures bounced between positive and negative territory ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks tumbled in Friday's holiday-shortened session, with the Dow ending the week about 1% lower, as concerns about a broader debt crisis in Europe pressured markets around the world.

European officials on Sunday announced an €85 billion bailout of Ireland and its banks. They also detailed a new protocol for similar rescues of European nations in the future.

The move raised worries about the stability of the European Union if other member nations require emergency financial aid. Portugal has emerged as the next likely candidate for a bailout, while investors are particularly worried about the outlook for Spain -- one of the EU's largest economies.

The combination of more details on the Irish bailout, and robust initial numbers from the holiday shopping weekend should give U.S. markets a boost, said Art Hogan, chief market strategist at Jefferies & Co.

But the shopping boon isn't quite over, as investors are expected to flock to online retailers to take advantage of Cyber Monday deals.

"It's amazing how much overall shopping has gone online, so we will see how those reports will come into us," Hogan said. "Consumers seem more involved this year rather than last year."

The eruption of violence on the Korean Peninsula last week, has added an additional source of uncertainty to the market.

Meanwhile, investors are bracing for a number of high-profile economic indicators this week -- including the government's monthly jobs report on Friday.

Companies: BP (BP) announced Sunday it would sell its interests in Pan American Energy to Bridas Corporation for $7.06 billion in cash. The move is part of BP's plan to sell $30 billion in assets by the end of 2011, in order to raise funds in the wake of the Gulf oil spill.

A Dutch court ordered U.S. based Johnson & Johnson (JNJ, Fortune 500) to pay a $130 million fine to pharmaceutical maker Basilea for a licencing agreement breech, Basilea said in a release.

Meanwhile, the Food and Drug Administration posted a report on its website that cites a variety of problems with a McNeil manufacturing facility in Puerto Rico. McNeil is a subsidiary of Johnson & Johnson, and was the source of this year's Tylenol recalls. Shares of Johnson & Johnson were little changed in premarket trading.

Economy: While no major economic reports are on tap for Monday, investors will take in data on housing, manufacturing and consumer confidence on Tuesday. On Friday, the government will issue its monthly jobs report.

World markets: European stocks were lower. Britain's FTSE 100 slipped 0.8%, the DAX in Germany dropped 0.8% and France's CAC 40 lost 1.0%.

Asian markets ended the session mixed. The Shanghai Composite lost 0.2%, while the Hang Seng in Hong Kong gained 1.3% and Japan's Nikkei rose 0.9%.

Currencies and commodities: The dollar strengthened against the euro, but fell against the Japanese yen and the British pound.

Oil for January delivery increased 66 cents to $84.42 a barrel.

Gold futures for December delivery rose $3.50 to $1,358.90 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 2.88% from 2.87% on Friday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |