Search News

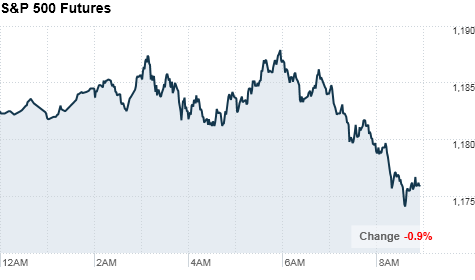

Click on the chart to see more futures data.

Click on the chart to see more futures data.

NEW YORK (CNNMoney.com) -- U.S. stocks are headed for a pull back at the open Tuesday after a weaker reading on the housing market and as investors remain worried about the health of Europe's economy.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were all lower ahead of the opening bell. Futures measure current index values against perceived future performance. The Dow is set to pull back by 100 points.

Stocks cut losses late in the day Monday, ending the session lower but holding above the 11,000 point level on the Dow.

The market has been whipsawed recently by worries about troubled European economies such as Ireland, Portugal and Spain.

"We have borrowing costs for Spain and Portugal going through the roof, and the worry is that they are being scrutinized by the speculators and that is adding to worries that the debt problem is going to continue to spread," said Peter Cardillo, chief market economist for Avalon Partners.

But the outlook for the U.S. economy could be back in the spotlight Tuesday after a weaker-than-expected reading on housing prices and ahead of reports on manufacturing activity and consumer confidence.

"Consumer confidence could be the moving factor for the market today," said Cardillo. "As consumer confidence builds so does consumer spending -- they go hand and hand -- so obviously that is the key for economic growth."

Investors will also take in comments from Federal Reserve chairman Ben Bernanke, who is scheduled to speak before a gathering of Ohio business leaders in Columbus.

The main focus for the week is on the government's monthly jobs report due out Friday.

Economy: The Case-Shiller index of home prices in 20 major U.S. markets came in with some bad news for the fragile recovery in the housing market: Home prices fell 2% in third quarter, after mostly steady gains since early 2009. Economists expected prices to rise 1% in September after a 1.7% increase the month before, according to a consensus of economists at Briefing.com.

After the market opens, the Conference Board's index of consumer confidence is expected to rise to 52 in November from 50.2 in October.

A measure of manufacturing in the Chicago area is expected to show that activity slowed slightly in November. Economists expect the November reading of Chicago PMI to fall to 59.6 from 60.6 in October. Any index reading over 50 indicates expansion.

World markets: Asian markets fell. The Shanghai Composite lost 1.6%, the Hang Seng in Hong Kong fell 0.7% and Japan's Nikkei dropped 1.9%.

European stocks rallied. Britain's FTSE 100, the DAX in Germany and France's CAC 40 were all up less than 1%.

Companies: Google (GOOG, Fortune 500) stock was down more than 1% in premarket trading after the European Commission said it will investigate whether the Internet search giant violated antitrust rules. Search service providers allege that Google gives its own services preferential placement on searches.

Furthermore, Google is looking to acquire the discount coupon retailer, Groupon, according to news reports. The Dealbook blog of the New York Times reported that Google may be bidding as much as $6 billion for Groupon.

Currencies and commodities: The dollar was up against the pound and the euro, but fell against the yen. Investors move into the dollar as a safe haven during times of economic uncertainty.

Oil for January delivery fell 96 cents to $84.77 a barrel.

Gold futures for December delivery rose $18.10 to $1,384.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 2.75% from 2.82% late Monday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |