Search News

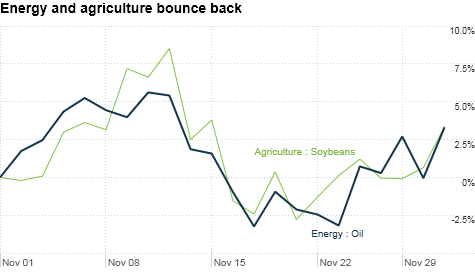

Click the chart for more on commodities.

Click the chart for more on commodities.

NEW YORK (CNNMoney.com) -- November was a wild month for commodities, with the market tracking stocks higher in the first week and then scaling way back as the month continued. Now it seems the correction may be over.

Both commodities and stocks got a double-whammy boost in the first week of the month, following the Republicans' success in the congressional election and the Federal Reserve's announcement of a second round of asset purchases. Oil, gold and silver all soared on Nov. 4 following the two events.

But the sharp rally didn't last long for commodities, which came under pressure starting the second week of November on concerns that China's economy is barrelling ahead at an unsustainable speed. A firmer dollar put pressure on commodities the second half of the month.

December could be the first sign of holiday cheer for commodities, with most sectors of the market rising considerably Wednesday.

"Today's been a turning point for commodities," said James Cordier, president at Liberty Trading Group. "It's signaling a correction finally being over in the dollar and commodities."

What's moving: Oil prices soared more than 3% to settle at $86.75 a barrel on Wednesday, while silver and platinum futures each added more than 1%.

Agriculture and consumer commodities were the major movers. Wheat prices shot up 7.2%, while corn added 4% and soybeans gained about 3%.

Cotton gained 1.2%, snapping a down trend. Cotton prices declined in late November, but they'd been on a tear for months. That was worrisome for consumers because higher cotton prices can translate into higher prices for jeans, T-shirts and other clothing.

Will consumers' wallets feel the pressure? Crops have been under particular pressure due to unfavorable weather conditions, said Dennis Gartman, who writes the daily trading newsletter The Gartman Letter.

"We've had this strange amalgam of weather conditions that have been especially bad for wheat," Gartman said. "We have too little rain in Kansas, but too much rain in Australia which tends to pummel the wheat into the ground. That changes the quality and the weight."

But Gartman doesn't think consumers will see higher prices in products like bread, pizza and baked goods.

"You could send wheat prices up a good amount and and the impact on a loaf of bread is negligible," Gartman said. "Honestly, a change in the price of packaging would have more of an effect."

But Cordier, of Liberty Trading Group, thinks the threshold between commodities and food prices is about to burst.

"I can't believe prices haven't gone up already," Cordier said. "I see all these interviews with major food company managers saying they're just barely holding the line. But it's impossible to hold forever."

Outlook: Cordier thinks commodities will continue to rise throughout December and into the first quarter of 2011, with grains, cocoa and sugar emerging strong.

Oil and soybeans will be the biggest winners at the beginning of next year, he said, adding that he thinks crude prices could hit $95 a barrel in the first quarter.

"Gold was the big story for a lot of this year, but it's fallen off its peak," Cordier said. "It won't outpace the other commodities as much, and now oil is the place to be." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |