Search News

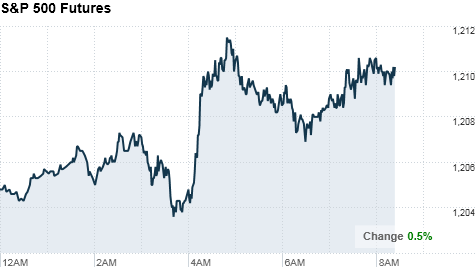

Click on the chart for additional futures data.

Click on the chart for additional futures data.

NEW YORK (CNNMoney.com) -- U.S. stocks were set to open slightly higher Thursday, following a rally in European and Asian markets, and as investors digest mixed data on the U.S. labor market. The European Central Bank announced Thursday morning that it will delay its withdrawal of stimulus measures.

Retailers are also reporting chain-store sales, which could give investors a glimpse into whether the consumer has really returned.

Dow Jones industrial average (INDU), S&P 500 (SPX) and Nasdaq (COMP) futures were modestly higher ahead of the opening bell. Futures measure current index values against perceived future performance.

Stocks had a banner day Wednesday, with all three major indexes surging more than 2% as signs of economic strength in the United States and China tempered worries about the European debt crisis. The blue-chip Dow index added 249 points, logging its biggest one-day gain since early September.

This week has what Doug Roberts, Chief Investment Strategist for ChannelCapitalResearch.com, calls the "triple play" for the labor market: ADP's private payroll report was out Wednesday, unemployment claims out Thursday and Friday brings the government's jobs report.

In a counter to Wednesday's strong read from payroll processor ADP, the government said Thursday that initial jobless claims surged by 26,000 to 436,000 in the latest week.

Investors will mostly be looking ahead to the government's big jobs report due before the opening bell on Friday: "it gives a lot more detail of what is going on," according to Roberts. Employers are expected to have added 130,000 jobs in November after adding 151,000 jobs in October. The unemployment rate is expected to remain unchanged at 9.6%.

The European Central Bank held a meeting Thursday morning, where President Jean Claude Trichet said the bank will delay its withdrawal of stimulus measures.

Recently, investors have worried that Spain is the next domino to fall in Europe. However, Spain does not intend to tap the European Union fund, Spanish Prime Minister Jose Luis Rodriguez Zapatero said in a CNBC interview Thursday morning.

Economy: The government's weekly jobless claims report came out before the start of trade. Jobless claims rose to 436,000. Economists polled by Briefing.com had expected that 422,000 Americans filed new claims for unemployment last week, after 410,000 filed in the previous week.

Investors will also be looking for reports from key retailers on their same-store sales through the morning. Discount food shopping giant Costco (COST, Fortune 500) announced that its sales were up 9% year over year. Clothing brand Abercrombie & Fitch (ANF) reported sales were up 22% and Macy's (M, Fortune 500) showed an increase of 6.1%. Same-store sales measure sales at stores open at least a year.

After the opening bell, the National Association of Realtors releases its pending home sales index, which is a measure of sales contracts for existing homes. The index is expected to be unchanged in October after slipping by 1.8% in September.

World markets: European stocks were all higher. Britain's FTSE 100 was up 0.9%, the DAX in Germany edged up 0.4% and France's CAC 40 gained 1%.

Asian markets had a strong day. The Shanghai Composite Index added 0.7%, the Hang Seng in Hong Kong added 0.9% and Japan's Nikkei jumped 1.8%.

Companies: Food and beverage giant PepsiCo (PEP, Fortune 500) said it would buy Russian food and beverage company Wimm-Bill-Dann Foods (WBD) for nearly $5.8 billion. The purchase will establish PepsiCo as the largest food and beverage business in Russia. Shares of PepsiCo were dipped 0.2% in premarket trading.

Also, Johnson & Johnson (JNJ, Fortune 500) announced that it is recalling 12 million bottles of over-the-counter Mylanta and almost 85,000 bottles of its AlternaGel liquid antacid. Shares of Johnson & Johnson were up 0.9% in premarket trading.

Currencies and commodities: The dollar slipped against the euro, but gained on both the British pound and the Japanese yen.

Oil for January delivery shaved 6 cents to $86.69 a barrel.

Gold futures for February delivery rose 10 cents to $1,388.40 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury dipped, pushing the yield to 3.0% from 2.96% late Wednesday. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |