Search News

Click chart for more on bonds and rates

Click chart for more on bonds and rates

NEW YORK (CNNMoney.com) -- Treasury prices moved sharply lower Tuesday as investors reacted to a compromise plan that will extend current tax rates for two years.

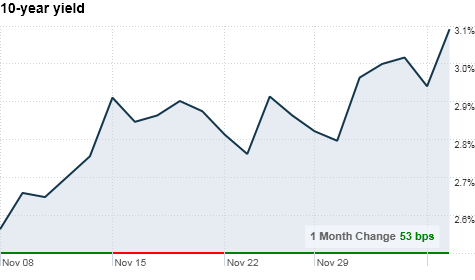

The sell-off pushed the yield on the benchmark 10-year note as high as 3.14%, a level not seen since late July. Treasury prices and yields move in opposite directions. The 10-year yield moved above 3% for the first time in four months late last week.

Tuesday's decline came one day after President Obama announced a deal with Republican leaders that would extend Bush-era tax cuts for two years and unemployment benefits for 13 months. It would also lower the payroll tax by two percentage points for a year.

While Treasury prices dropped, stocks rallied on the news. Investors have been focused on the tax cuts for weeks as lawmakers in Washington grappled with reaching a compromise during the notoriously unproductive lame-duck legislative session.

The result? Investors are reveling in the clarity.

"It's taking a little bit of risk out of the market," said Kim Rupert, fixed income analyst at Action Economics. "There was uncertainty about the fiscal outlook, and even though nothing is signed, it's understood at this point."

The deal translates into a short-term boom for yields, but the measure could cost the government between $700 billion and $800 billion, which will add to an already sharp run-up in government debt.

Low demand for a mid-day Treasury Department auction of $32 billion in short-term 3-year notes pushed prices down even further.

The auction's bid-to-cover ratio, a measure of demand, was 2.91, the lowest level since February.

Tuesday's sale will be followed by auctions of 10-year notes on Wednesday and 30-year notes on Thursday.

On Tuesday, the yield on the benchmark 10-year note closed at 3.13%, up from its close of 2.92% on Monday.

The 30-year yield ticked up to 4.37%. The yield on the 2-year note increased to 0.54% and the 5-year note rose to 1.73%. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow | 32,627.97 | -234.33 | -0.71% |

| Nasdaq | 13,215.24 | 99.07 | 0.76% |

| S&P 500 | 3,913.10 | -2.36 | -0.06% |

| Treasuries | 1.73 | 0.00 | 0.12% |

| Company | Price | Change | % Change |

|---|---|---|---|

| Ford Motor Co | 8.29 | 0.05 | 0.61% |

| Advanced Micro Devic... | 54.59 | 0.70 | 1.30% |

| Cisco Systems Inc | 47.49 | -2.44 | -4.89% |

| General Electric Co | 13.00 | -0.16 | -1.22% |

| Kraft Heinz Co | 27.84 | -2.20 | -7.32% |

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |